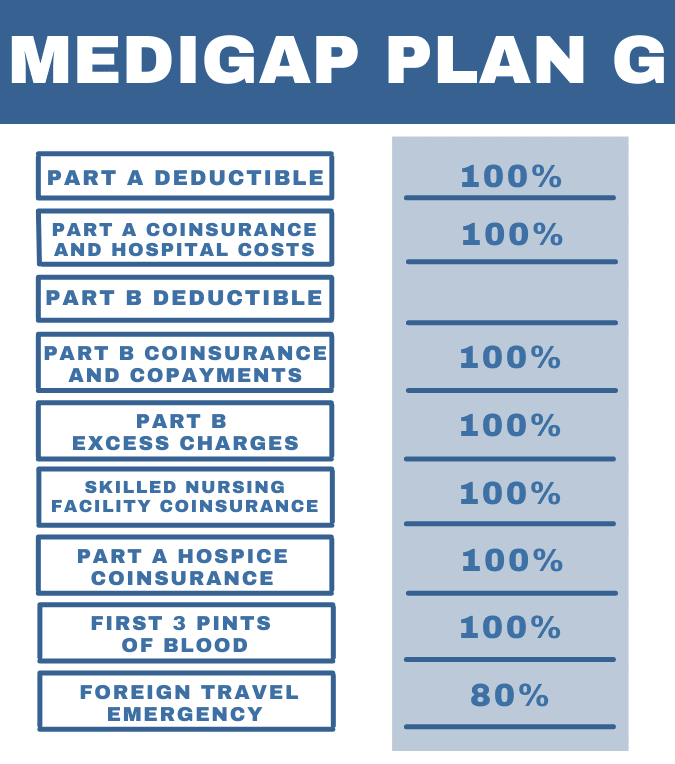

Medicare supplement plan G is a type of Medicare supplemental insurance. It provides coverage for the Medicare Part A deductible, Part A and B coinsurances or copayments, and hospital charges. Plan G also covers many different types of costs that are not covered by traditional Medicare, such as outpatient services like lab tests and physical therapy visits. Plan G was introduced in 2006 to help fill gaps left by traditional Medicare coverage. It is important to tale full advantage of all your Medicare benefits. A big part of what would be considered your retirement benefits would be Medicare.

Medicare Supplement/Medigap Overview

Understanding Medicare supplement plans is an important first step. Medicare supplement plans are available in different “tiers” of coverage. The plan that is best for you will depend on your health needs and budget.

Medigap Plan G was introduced in 2006 to fill gaps left by traditional Medicare coverage. It covers the Medicare Part A deductible, the hospital coinsurance or copayment, as well as some additional costs like lab tests, outpatient visits under Medicare Part B.

What Does Plan G Cover?

Medigap Plan G covers many costs not covered by traditional Medicare coverage such as outpatient services like lab tests and physical therapy visits. It also covers the cost of copays, coinsurance or deductibles for many other types of health care providers

This plan does cover some benefits that Part A does not include, including the deductible and coinsurance for hospitalizations, skilled nursing care, home health care, and hospice care.

This plan also covers the Part B coinsurance and copayments on outpatient services that are either medically necessary or preventive. The only out-of-pocket with Plan G under your Medicare Part B is the annual deductible, which is $203 in 2021.

Original Medicare

Medicare Part A

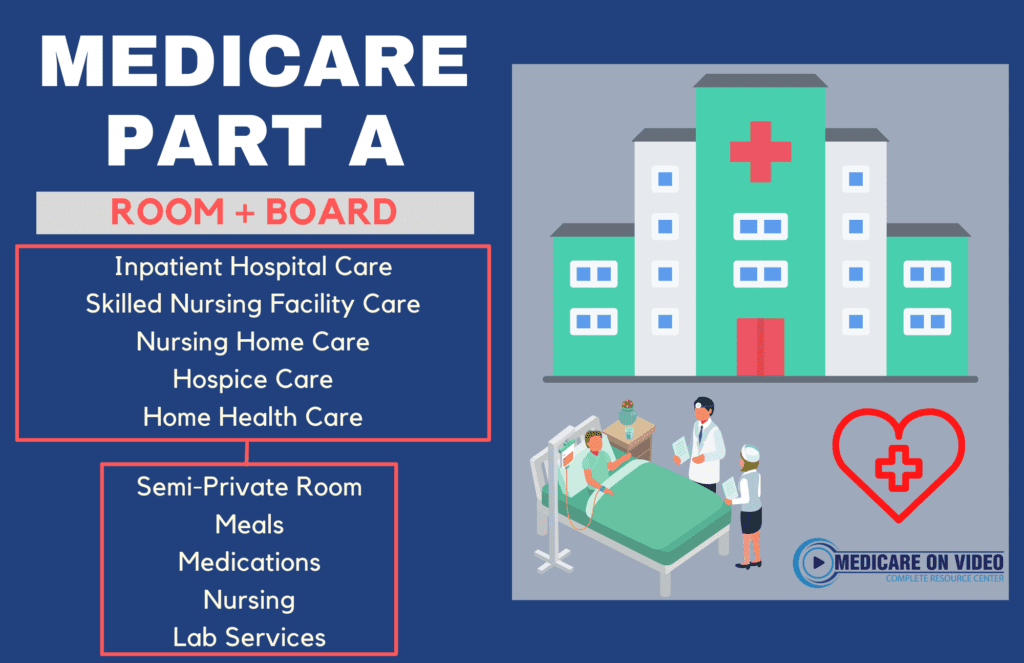

Medicare Part A is a program that helps pay for hospital stays. You can consider Part A your “room and board” in the hospital, including things such as a semi-private room, meals, medications, and nursing care.

When you enroll in Medicare, your coverage will be automatic enrollment in just Original Medicare, unless you choose to sign up for extra benefits, such as Medicare Supplement Plan G. There are no deductibles or copays when using Original Medicare with Medigap G for hospital care.

What are the Pros and Cons of Medicare Part A?

Pros: It is one of the two main parts of traditional Medicare and has extensive coverage. This includes hospitalization, skilled nursing facility care after being discharged from the hospital, hospice care for terminal illnesses and some home health services

Cons: The deductible and coinsurance can be expensive so it’s important to find out if the Medicare supplement plan you’re considering will be able to cover these costs.

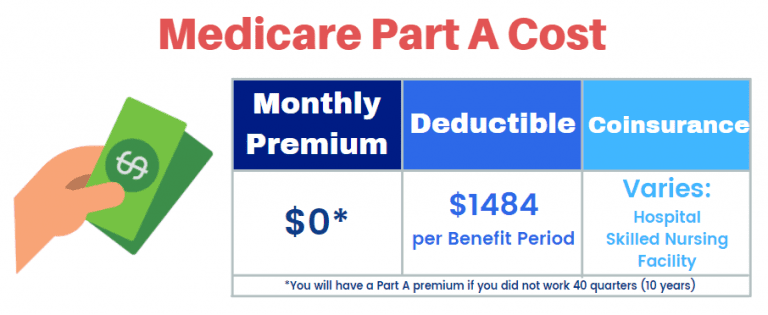

How Much does Medicare Part A cost?

Medicare Part A typically has no monthly premium for most people. If you have worked at least 40 quarters (10 years), you are eligible for premium free Medicare Part A. If you have not worked the required 40 quarters, you will pay a premium for Medicare Part A depending on the amount of quarters you worked. In 2021, if you worked 30-39 quarters, you will pay $259 per month for Part A. If you worked less than 30 quarters, you will pay $471 per month for Part A.

Although most people do not have a monthly premium for Medicare Part A, there are other costs associated. Part A has a deductible of $1,484 (in 2021), as well as coinsurances for hospitalizations, skilled nursing care, hospice, and home health care. Medicare Supplement plans, such as Plan G, can cover these costs, leaving you with minimal out-of-pocket expenses.

What Does Medicare Part A Cover?

Part A covers health care in the hospital, skilled nursing facility, hospice and some home health services. It also includes some coverage for these types of providers after being discharged from a hospital. You can think of Medicare Part A as your “room and board” coverage when hospitalized, as it pays for things such as a semi-private room, meals, nursing care, and prescription medications while hospitalized.

What Part A Does Not Cover

Part A does not cover services that are considered “outpatient.” These services would fall under Medicare Part B. Medicare Part A also does not cover all costs associated with hospitalization. This includes the deductible, which is per benefit period (not annual) and the copayments or coinsurances. Something that surprises people is that Part A only covers a skilled nursing facility for a short period of time. It was never intended to provide coverage for long term care. Medigap plans, like Medicare Supplement Plan G, are needed in order to have the coverage that Part A cannot provide.

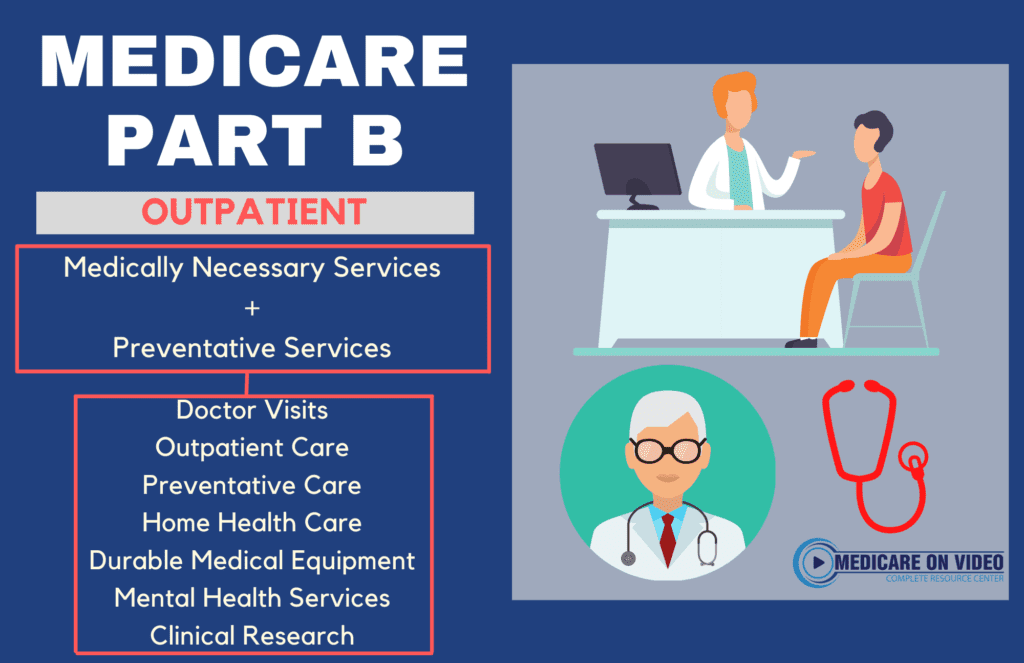

Medicare Part B

Medicare Part B is the counterpart to Medicare Part A under Original Medicare. This part of Medicare is considered your outpatient coverage. Part B covers outpatient care like lab work, x-rays and visits with your primary physician. It also includes coverage for these types of providers after being discharged from a hospital.

Coverage under Part B falls into two categories: medically necessary services and preventive services.

What are the Pros and Cons of Medicare Part B?

Pros: Medicare Part B provides extensive coverage for outpatient services. This coverage includes physician visits (primary and specialist), as well as procedures and assessments.

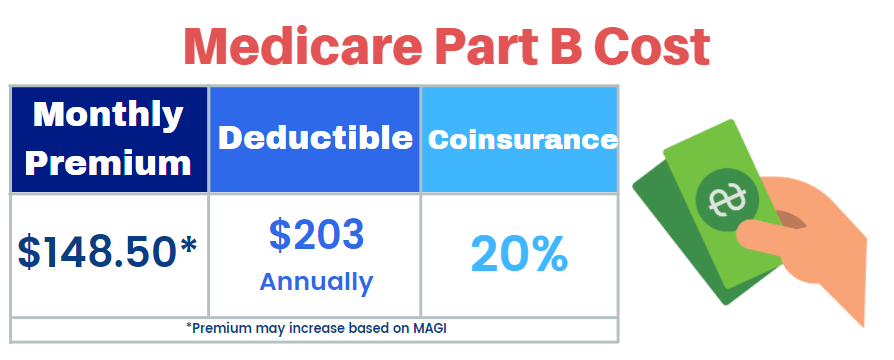

Cons: Medicare Part B does not cover 100% of your outpatient costs. There is an annual deductible of $203 (in 2021), as well as 20% cost-share if all medically necessary services. The 20% coinsurance, however can will be covered under a Medigap plan like Plan G.

How much does Medicare Part B cost?

Unlike Medicare Part A, Medicare Part B does have a monthly premium. In 2021, the standard monthly premium for Medicare Part B is $148.50. This premium, however, can increase based on your income from the last two years. If you made a higher modified adjusted gross income (MAGI) than the standard level of Medicare beneficiaries, you will pay a higher premium for Part B. The higher premium number is dependent on exactly what your MAGI was from two years ago.

What Does Medicare Part B Cover?

Medicare Part B covers services that are considered either medically necessary or preventive.

Medically necessary services are procedures and equipment that are needed for the diagnosis and treatment of a medical condition. Essentially, these services are things such as doctor visits, outpatient care, home health care, and durable medical equipment.

Preventive services are services that will attempt to prevent the diagnosis or progression of certain medical conditions. These services include screenings, vaccinations, and assessments. Typically, preventive services are covered at 100% under Medicare Part B and do not include the 20% coinsurance.

Part B also covers certain types of prescription drugs. The coverage would be for drugs that are administered in a doctors office.

What Does Medicare Part B Not Cover?

Medicare Part B does not cover some cost-share, such as an annual deductible of $203 in 2021, or the 20% coinsurance for all medically necessary services. Medigap plans, like Medicare Supplement Plan G, are designed to pick up the 20% coinsurance in order to significantly lower your out-of-pocket expenses.

Medicare Part B does not also cover things such as inpatient services, which are covered under Medicare Part A. There is also no coverage for dental, vision, or hearing services, prescription drugs, or long-term care.

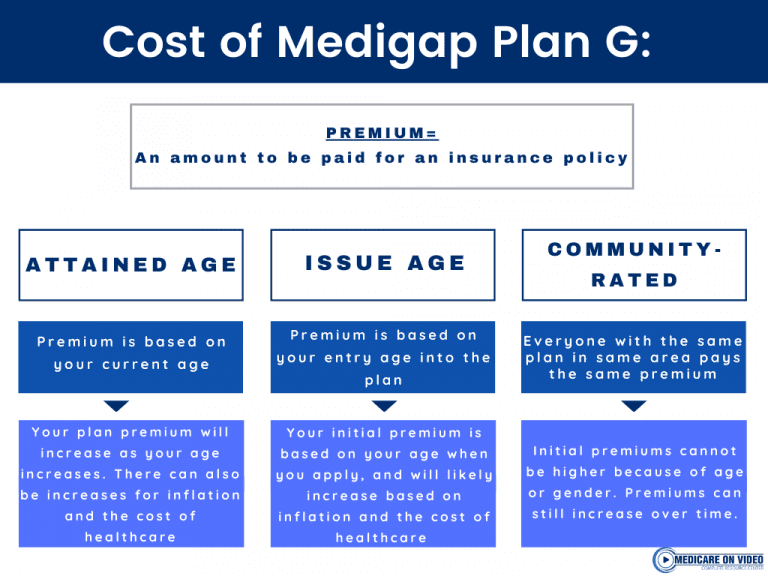

What Does Plan G Cost?

The monthly premium cost for Plan G is dependent on 3 different factors: age, gender, and location. The first and most defining factor will be your location, as different states have different ways of rating monthly Medicare supplement premiums- attained-age, issue-age or community-rated. From there, your age and gender will also impact the amount of your monthly premium. There can be other factors that will affect your premium, including tobacco use.

What are the Pros of Plan G?

The biggest, and most important, pro of Plan G is the limit in out-of-pocket costs. Essentially, when paired with Original Medicare, your only out-of-pocket expense for Medicare Parts A and B is the annual Part B deductible, which is $203 in 2021. Plan G is going to cover the Part A deductible, as well as Part A and Part B coinsurances and copayments. With Plan G, you can be sure of what your healthcare costs will be per month without worrying about breaking the bank on a medically necessary procedure.

Medicare Plan G vs F

In almost all cases, Plan G is a better value than Plan F. The only difference in the two plans is that Plan F covers the Medicare Part B deductible and Plan G does not. What makes Plan G the better value? The savings on premium for Plan G is almost always more than that deductible.

How Does Plan G Compare to Plan N?

This is one that you do want to compare. Watch my video and I walk you right through it.

Who Can Sign Up for Plan G?

Anyone who is enrolled in Original Medicare can sign up for Plan G. You must have both Medicare Part A and Part B in order to apply. If you are new to Medicare and within 6 months of your Part B effective date, you will be automatically accepted into any Plan G you apply for, no matter which insurance company it is with. If you are past those first 6 months of Part B, depending on which state you live in, you will likely have to pass medical underwriting to be approved, meaning you must be in good health in order to enroll in a Plan G.

How and When Can You Enroll in Plan G?

You can enroll in Plan G at any time during the year. There is no open enrollment period for Medicare Supplement plans. If you are new to Medicare, you want to enroll into Plan G when your Part B begins to avoid any gaps in coverage. If you are already enrolled in Medicare, you can apply for Plan G during any month of the year, but must be able to pass medical underwriting. If you are currently enrolled in a Medicare Advantage Plan, you will want to wait until the Annual Election Period, also known as open-enrollment, to apply.

You can enroll in Plan G at any time during the year. There is no open enrollment period for Medicare Supplement plans. If you are new to Medicare, you want to enroll into Plan G when your Part B begins to avoid any gaps in coverage. If you are already enrolled in Medicare, you can apply for Plan G during any month of the year, but must be able to pass medical underwriting. If you are currently enrolled in a Medicare Advantage Plan, you will want to wait until the Annual Election Period, also known as open-enrollment, to apply.

How Do I Sign Up for Plan G?

As you can see, there are many options to choose from when it comes to Medicare. When deciding which plan is best for your needs, take into account what factors are most important to you and whether or not the monthly premium will be affordable. If this information has helped you narrow down your decision-making process and given you peace of mind that all decisions were made with sound judgement, we’re happy! We would love the opportunity to help answer any more questions about Medicare plans G through N – just give us a call at 1-877-885-3484.