What Does Medicare Cover?

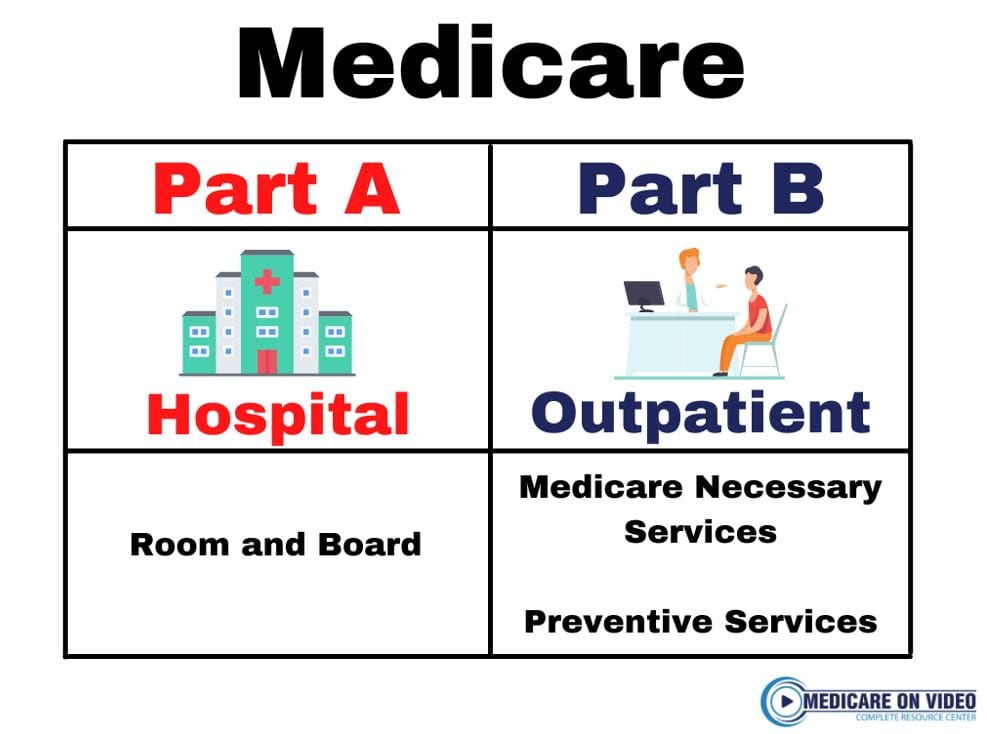

Original Medicare consists of two parts- Medicare Part A and Medicare Part B. Medicare Part A is your hospital coverage, and Medicare Part B is your outpatient coverage.

Medicare Part A:

You can think of Medicare Part A as your “room and board” in the hospital. This coverage includes things such as your inpatient hospital care, skilled nursing facility care, nursing home care, hospice care, and home healthcare. Under these services, Part A includes a semi-private room, meals, medications (while admitted), nursing care, and lab services.

Medicare Part B:

Medicare Part B is your outpatient care and includes two categories of covered services. The two categories of services are medically necessary services and preventive services. Included in these two categories are doctor visits, outpatient care, preventative care, home health care, durable medical equipment, mental health services, and clinical research.

Although Medicare Parts A and B cover a large variety of services, they do not cover everything relate to your healthcare needs. In fact, there are a few major services that are not covered by Medicare at all that you as a Medicare beneficiary need to be aware of.

1) Medicare Does Not Cover Routine Dental

It is extremely important to maintain dental care throughout your life, especially as you age. Unfortunately, Original Medicare does not include routine dental care as a benefit of either Medicare Part A or B. This means that things such as cleaning, fillings, root canals, dentures, and other dental procedures are not covered by Medicare. There are certain instances where Medicare Part A will cover emergency dental care during a hospitalization, but it is only for certain medical diagnoses.

It is extremely important to maintain dental care throughout your life, especially as you age. Unfortunately, Original Medicare does not include routine dental care as a benefit of either Medicare Part A or B. This means that things such as cleaning, fillings, root canals, dentures, and other dental procedures are not covered by Medicare. There are certain instances where Medicare Part A will cover emergency dental care during a hospitalization, but it is only for certain medical diagnoses.

You do have some options for additional coverage for dental care outside of Original Medicare. These options include stand alone dental insurance plans (typically combined with vision and/or hearing coverage), and discount dental plans. There are also some Medicare Advantage plans that include a dental insurance benefit.

2) Medicare Does Not Cover Routine Vision

Just like with dental care, Original Medicare also excludes routine vision care from the covered services. Routine vision care includes things such as vision exams, glasses, and contacts. You will be responsible for 100% of the cost on these services. There are certain aspects of vision care that are included in Medicare’s benefits, such as assessment and treatment for cataracts, assessment and treatment of age-related macular degeneration, diabetic retinopathy, and glaucoma.

Just like with dental care, Original Medicare also excludes routine vision care from the covered services. Routine vision care includes things such as vision exams, glasses, and contacts. You will be responsible for 100% of the cost on these services. There are certain aspects of vision care that are included in Medicare’s benefits, such as assessment and treatment for cataracts, assessment and treatment of age-related macular degeneration, diabetic retinopathy, and glaucoma.

As with dental care, you have additional coverage options available for vision care. These options include stand alone vision insurance plans (typically combined with dental and/or hearing coverage), and discount dental/ vision plans. There are also some Medicare Advantage plans that include a vision insurance benefit.

3) Medicare Does Not Cover Prescription Drugs

One of the biggest surprises people face when enrolling into Medicare, is that prescription drugs are not covered under Original Medicare Parts A and B. That’s right, if you are enrolled into just Medicare Parts A and B, you are solely responsible for the cost of any and all prescription medications you take. Paying out of pocket for these prescriptions can become expensive very quickly, as the majority of seniors take at least one prescription daily, if not more. It is important to note that if you are given a prescription drug in the hospital or the drug is administered at a doctor’s office, such as an injection, the medication can be covered under either Medicare Part A or Part B.

One of the biggest surprises people face when enrolling into Medicare, is that prescription drugs are not covered under Original Medicare Parts A and B. That’s right, if you are enrolled into just Medicare Parts A and B, you are solely responsible for the cost of any and all prescription medications you take. Paying out of pocket for these prescriptions can become expensive very quickly, as the majority of seniors take at least one prescription daily, if not more. It is important to note that if you are given a prescription drug in the hospital or the drug is administered at a doctor’s office, such as an injection, the medication can be covered under either Medicare Part A or Part B.

There is an optional part of Medicare that beneficiaries can enroll in to help with prescription costs, known as Medicare Part D. This part of Medicare is designed to reduce the cost of medications for seniors. Although this part of Medicare is optional, if you do not enroll when you are first eligible, you are at risk of receiving a lifetime late enrollment penalty in the future if you ever choose to enroll. For more information, visit our page on Medicare Part D.

4) Medicare Does Not Cover Long Term Care

As a Medicare beneficiary, it is important to understand the distinction between skilled nursing care and long-term care. Original Medicare, specifically Medicare Part A, will cover up to 100 days of skilled nursing care. Original Medicare, however, does not cover long-term care, which extends past day 100, typically in a skilled nursing facility. If you require long-term care, you will be responsible for 100% of the associated costs.

As a Medicare beneficiary, it is important to understand the distinction between skilled nursing care and long-term care. Original Medicare, specifically Medicare Part A, will cover up to 100 days of skilled nursing care. Original Medicare, however, does not cover long-term care, which extends past day 100, typically in a skilled nursing facility. If you require long-term care, you will be responsible for 100% of the associated costs.

Following a qualifying three day hospital stay, you may be recommended to continue care at a skilled nursing facility prior to returning home. Medicare Part A will cover up to 20 days at no cost to you of skilled nursing care. Part A will also cover days 21-100, with a daily copayment amount of $185.50 (in 2021) for the beneficiary. Past day 100, Original Medicare will not cover any further services related to skilled nursing care. There are many Medicare Supplement plans with included benefits to cover the copayment of days 21-100. Visit our page on Medicare Supplement plans for more information.

There are optional long-term care insurance plans available that are designed to help cover the costs associated with long-term care facilities.

5) Medicare Does Not Cover Foreign Travel Emergency

One of the things that most people look forward to during retirement is the ability to travel. The last thing we want to think about is healthcare coverage while on a long awaited vacation. Unfortunately, it is something we need to be aware of, as Original Medicare does not offer any foreign travel emergency coverage for beneficiaries. This can be a large concerning aspect of Medicare, as a hospitalization in a foreign country can lead to very large medical bills.

One of the things that most people look forward to during retirement is the ability to travel. The last thing we want to think about is healthcare coverage while on a long awaited vacation. Unfortunately, it is something we need to be aware of, as Original Medicare does not offer any foreign travel emergency coverage for beneficiaries. This can be a large concerning aspect of Medicare, as a hospitalization in a foreign country can lead to very large medical bills.

There are different options available to ensure adequate medical coverage while abroad. There are many Medigap plans that offer foreign travel emergency coverage up to $50,000. You can find more information on these plans on our Medicare Supplement comparison page. There are also some Medicare Advantage plans that offer a level of foreign travel benefit, as well as stand alone travel insurance plans.

What You Need to Know

Overall, it is important to remember that although Medicare is fantastic insurance, it does not cover every aspect of our health coverage needs. It is crucial to understand not only the limitations in Medicare coverage, but also the additional options to ensure full and complete coverage. Give us a call at 877-885-3484 and we will walk you through what you need to know about your Medicare coverage!