If you are eligible for Medicare and want to enroll, there are several ways to apply for coverage. The best way to apply will depend on your specific circumstances. For instance, if you are already drawing Social Security benefits, you do not need to apply for Medicare, as you will be enrolled in Parts A and B automatically. If you are turning 65 and want to enroll, you can either apply online, or contact Social Security by phone to apply. If you are past the age of 65 and leaving an employer plan, you can also apply online or by faxing documents to Social Security, as you will have additional forms to attach to your application.

In most cases, you will be mailed your Medicare ID card right away so that you can start getting your benefits as soon as possible!

The best thing you can do to make sure you get what you’re entitled to is to apply as early as possible, so you can start using your new Medicare health and drug coverage.

Enrolling in Medicare at 65

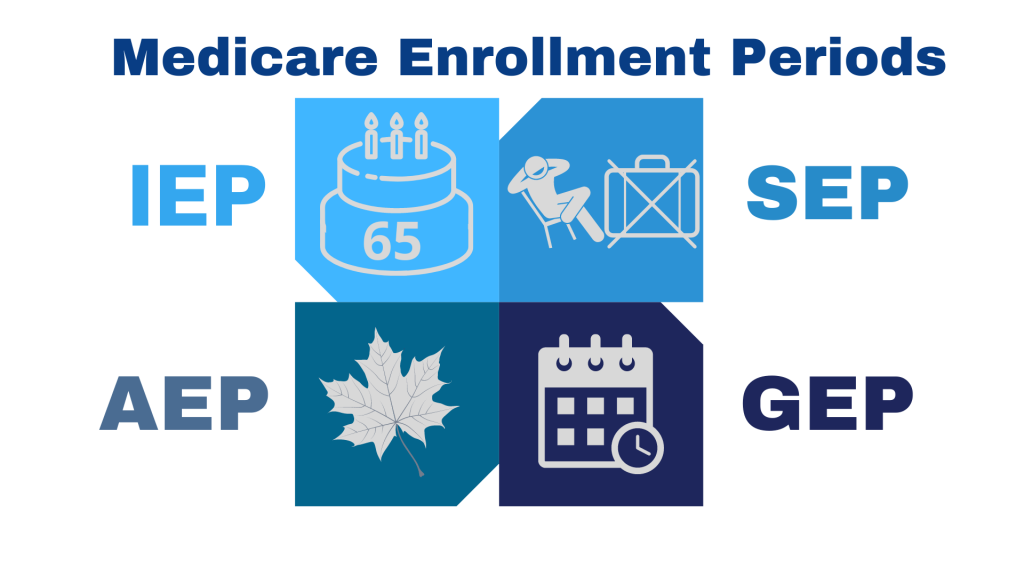

There are a few different Medicare Enrollment Periods depending on when you need your coverage to begin.

The time around your 65th birthday is called your Initial Enrollment Period (IEP), and is when you are first eligible to apply for Medicare. Your IEP begins 3 months prior to your 65th birthday, and ends 3 months after your 65th birthday. During your IEP, you can enroll in Part A or Part B without paying a late enrollment penalty. If you do not have another form of creditable health insurance, such as an employer plan, you will want to enroll in Medicare during your Initial Enrollment Period, in order to avoid a penalty.

What You Need to Provide When Signing up:

You will apply for Medicare through the Social Security Administration. Before beginning your application, it is important to have the appropriate information with you:

- Social Security Number and Date of Birth: Many people are surprised to learn that, when it comes time to sign up for Medicare, they need only their name and date of birth for verification. If you forget your Social Security number or have never had one, you’ll be asked to provide details about your employment history or other information that can help verify your identity.

- An Email Address: People who live in the U.S., even if they don’t have a computer, can sign up for online services by providing an email address. Providing an email address is important, as you will receive confirmation when you submit your application.

- A Phone Number and Mailing Address: It’s also important to provide a phone number and mailing address when signing up for Medicare, so that any mail from your health plan arrives in a timely manner and you can receive information about how to enroll in an optional Part D prescription drug plan.

How To Apply for Medicare

There are multiple ways you can submit an application for Medicare. The two easiest ways to apply are:

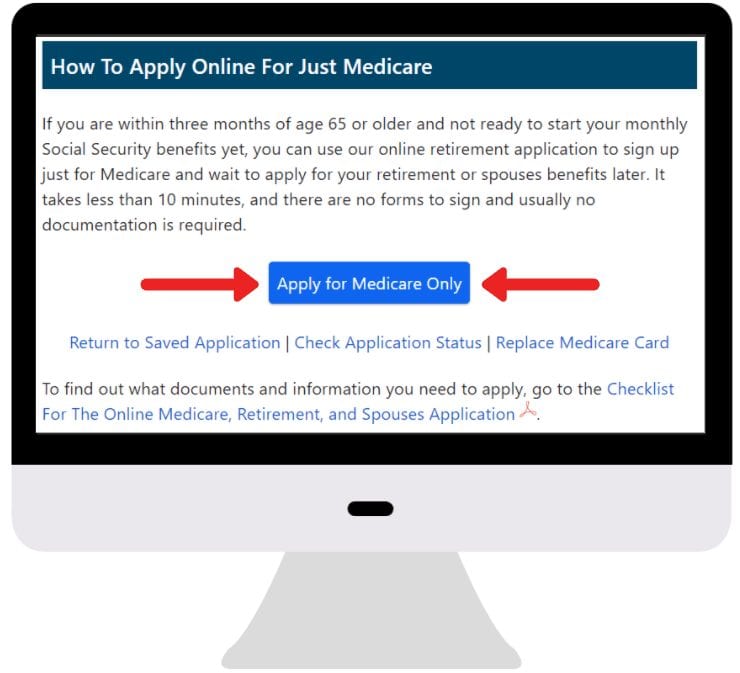

Apply Online

You can submit an application for Medicare directly through the Social Security website. You can also track the status of your application through your My Social Security portal.

We have created the easy to use link www.startpartb.com that will bring you directly to the Medicare application page on Social Security’s website.

Apply via Phone and Fax

You can also contact your local Social Security office directly to submit an application for Medicare. Due to COVID-19, local offices remain closed to the public, but are still available for contact via phone. You can retrieve a fax number from your local office to submit your Medicare application.

What Are the Different Medicare Enrollment Periods?

Aside from being able to enroll in Medicare when you turn 65, there are also other enrollment periods to be aware. These periods are especially important if you plan to continue working past age 65, or did not apply for Medicare when first eligible for whatever reason.

Initial Enrollment Period: Your Initial Enrollment Period (IEP) is the time period that surrounds your 65th period. This IEP begins 3 months prior to the month of your 65th birthday, includes the month of your 65th birthday, and concludes 3 months following your 65th birthday. During this time period, you can apply for Medicare Part A and Part B. Depending on when you apply during this time period, your effective date for Medicare Part B will change. If you apply prior to turning 65, Part B will begin the month of your 65th birthday. If you apply during your birthday month or in the 3 months following, your Medicare Part B effective date is variable.

If you do not have an employer-sponsored health insurance plan through either yourself or a spouse, you will want to initiate your Medicare coverage during this IEP. If you do not, you will be subjected to a late enrollment penalty when you apply for Medicare later, as well as be restricted to applying during the General Enrollment Period (GEP).

Special Enrollment Period: If you or your spouse are Medicare eligible and are still working, you may choose to remain on your same employer group health plan. If your employer-sponsored plan is active group coverage with 20+ employees enrolled in the plan, this will be considered creditable coverage, which allows you to defer your Medicare enrollment until retirement.

Once you leave your employer health plan, you will be eligible for a Special Enrollment Period (SEP). You will be given 8 months from the termination of the employer health plan to apply for Medicare without a late enrollment penalty. Social Security will require documentation to be completed by your employer to show proof of coverage (CMS L-564).

General Enrollment Period: If you haven’t signed up for Part B when you’re first eligible and did not have creditable health insurance, you can apply for Medicare during the General Enrollment Period (GEP). The GEP will run from January 1 to March 31 every year, with coverage beginning on July 1st of the same year. You will also be subjected to a lifetime late enrollment penalty that is dependent on how long you delayed your Part B application.

Annual Election Period: The Annual Election Period (AEP), also known as Open Enrollment Period, is the time period every year where you can make changes to your current Medicare coverage. The AEP begins October 15th and end December 7th, with changes becoming effective on January 1st of the following year. During AEP, Medicare beneficiaries can enroll into, change, or disenroll from both Medicare Advantage Plans and Medicare Part D plans.

What About Medicare Drug Plans?

People who are eligible for Medicare Parts A & B can also enroll in a Part D prescription drug plan. Medicare Part D is an optional program that offers coverage for prescription drug costs and can significantly reduce out-of-pocket expenses for your medications. Whether you are applying for Medicare during your IEP or you qualify for an SEP after retiring, you can apply for your Medicare Part D plan when you are applying for Medicare Part B. If you do not, you will have to wait until the Annual Election Period to apply for a Medicare Part D plan.

People who are eligible for Medicare Parts A & B can also enroll in a Part D prescription drug plan. Medicare Part D is an optional program that offers coverage for prescription drug costs and can significantly reduce out-of-pocket expenses for your medications. Whether you are applying for Medicare during your IEP or you qualify for an SEP after retiring, you can apply for your Medicare Part D plan when you are applying for Medicare Part B. If you do not, you will have to wait until the Annual Election Period to apply for a Medicare Part D plan.

Just like Medicare Part B, if you do not enroll into a Medicare Part D plan when you are first eligible and decide to enroll later, you will be subjected to a lifetime late-enrollment penalty. This penalty is compounding and will increase the longer you delay your Part D enrollment.

When to Get a Medicare Supplement Plan

When you enroll in Medicare Part B, you are also given the option to enroll in a Medicare Supplement Plan. These plans, also known as Medigap plans, are designed to cover the gaps left by Original Medicare.

There are 10 Medigap plans available, and all plans are standardized. The benefits will vary from plan to plan, so it is important to understand the different coverage levels. Most plans will cover the majority of out-of-pocket costs left by Original Medicare, such as the Part A deductible and coinsurances, as well as the 20% Medicare Part B coinsurance.

Give us a call at 877-885-3484, and a licensed agent will send you a free quote on the different plans available in your area, as well as answer any questions you may have.

Enrolling in a Medicare Advantage Plan

You also have the option to enroll in a Medicare Advantage Plan when you begin your Medicare coverage. These plans are also known as Medicare Part C. With a Medicare Advantage Plan, you will leave Original Medicare, and be covered under Medicare Part C by an insurance carrier. These plans are different based on your zip code and differ from the Medigap Plans. Medicare Advantage plans include networks of doctors and hospitals, as well as things like referrals, pre-authorizations, and maximum out-of-pocket amounts that can reach up to $7,550 in 2021.

Is it Mandatory to Sign Up for Medicare at Age 65?

It is not mandatory to enroll in Medicare at age 65, but there are criteria you will want to meet first. Most importantly, if you do not have any form of creditable health insurance, it is important to understand that if you do not enroll in Medicare at age 65, you are going to face a late-enrollment penalty when you finally enroll. The penalty is a lifetime penalty that will increase your premium significantly based on how long you delayed your enrollment.

If you plan to continue working past age 65 and are happy with your employer-sponsored health insurance plan, you can delay your Medicare enrollment without incurring a late-enrollment penalty. Once you decide to retire and leave the plan, you can qualify for a Special Enrollment Period, in order to avoid delays with your Medicare coverage beginning.

We understand that this can all be very confusing, because there are so many different timelines to be aware of when it comes to enrolling in Medicare. Give us a call at 877-885-3484 and an experienced agent will walk you through everything you need to know about applying for Medicare. You can also learn more about all of your options anytime as well by visiting our website at www.medicareonvideo.com.