There is a lot of talk in Washington right now about Medicare expansion. There are bills being proposed that expand not only the services offered under Medicare, but also the pool of people who are eligible for Medicare!

$3.5 Trillion Bill to Expand Medicare

On August 24th, the House passed the first step to move along their $3.5 trillion budget proposal that impacts a lot of social programs. One of the main programs targeted with this budget proposal is Medicare. This bill looks at expanding Medicare coverage in multiple ways. The two big targets of Medicare expansion are lowering the eligibility age, and increasing the benefits offered under Original Medicare.

On August 24th, the House passed the first step to move along their $3.5 trillion budget proposal that impacts a lot of social programs. One of the main programs targeted with this budget proposal is Medicare. This bill looks at expanding Medicare coverage in multiple ways. The two big targets of Medicare expansion are lowering the eligibility age, and increasing the benefits offered under Original Medicare.

Will Medicare be Available at Age 60?

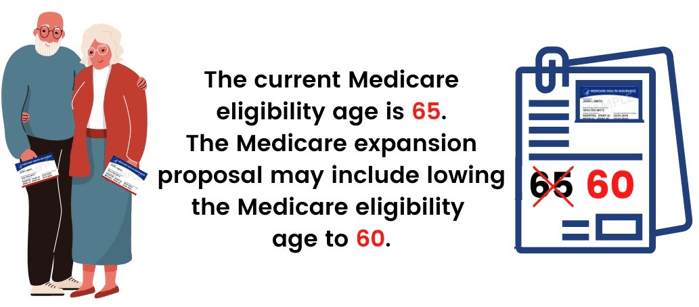

Currently, unless you have been on Social Security Disability for 24+ months, most people become Medicare eligible at the golden age of 65. That’s right! You have to wait until you are 65 years old to enroll in Original Medicare Parts A and B. You may notice that this age does not line up with Social Security benefits, which you can begin drawing in partial fulfillment at age 62 (full retirement is currently 66 and 2 months).

One of the possible ideas proposed in this new Medicare expansion bill is to lower the eligibility age of Medicare from 65 down to age 60.

The lowering of Medicare’s eligibility age has pros and cons to it. One pro is that it gives people the option to retire or leave their group employer insurance at an earlier age. There are also a lot of people who retire prior to age 65, and are forced to either enroll in a very expensive individual health insurance plan, or take COBRA benefits for as long as possible before becoming Medicare eligible.

On the flipside, there are also some drawbacks to lowering the Medicare eligibility age. One major and important drawback is simple: money. Currently, 10,000 per day turn 65 and become Medicare eligible. If the age is lowered to 60, that number increase exponentially. This larger influx of people into Medicare will result in higher payouts by Medicare to accommodate the increase in services. This increase in spending may have not been seen as such a big issue, if there wasn’t already an exhaustion of the Medicare trust fund on the horizon.

Will Medicare Include Dental Vision and Hearing?

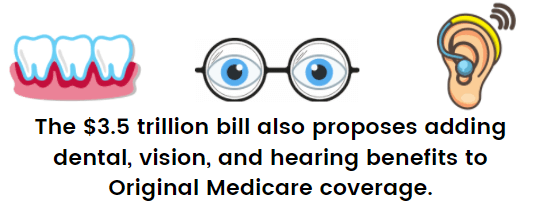

If you are enrolled in Original Medicare with or without a Medicare Supplement plan, you may notice that a big missing piece in coverage is dental, vision, and hearing insurance. Currently, Medicare does not offer any coverage for dental, vision, or hearing, except in extreme cases. Honestly, it is extremely frustrating, as our need for dental services or eye exams does not stop once we decide to retire.

One of the other proposed items included in the expansion of Medicare, is adding dental, vision, and hearing (DVH) benefits to Original Medicare’s coverage. Similar to lowering the eligibility age, this addition of coverage has pros and cons, mainly related to money and cost.

Adding DVH benefits will save Medicare beneficiaries a lot of money but decreasing the need for stand-alone plans or payment options with their providers. On the flip side, however, this addition of benefits is going to also significantly increase Medicare’s spending.

Is Medicare Going Bankrupt?

The short answer to this is, no. Since the introduction of Medicare, there have been multiple times where it seemed as though Medicare would run out of funds. Luckily, there has always been some maneuvering that has helped the program move along without exhausting all of it’s revenue.

Currently, the Congressional Budget Office (CBO) and the 2020 Medicare Trustees Report are projection an exhaustion of the Hospital Insurance Trust Fund portion of Medicare at some point between 2024-2026. This Hospital Insurance Trust Fund is the portion of Medicare revenue that pays for Medicare Part A. Medicare Part A is your hospital insurance.

There are currently possible ideas on how to renew the HI Trust Fund and prevent insolvency such as increasing revenue through taxes, cutting spending by Medicare beneficiaries, and increasing monthly premiums.

The big question that remains, however, is whether the expansion of Medicare is going to deplete the Medicare trust funds even further. Only time will tell.