One of the first questions we get asked when working with a new client is “Which Medicare supplement is the best?” Unfortunately, the answer isn’t as straightforward as you’d think. Many personal considerations factor into choosing a Medicare supplement.

However, if you’re looking for the supplement that will give you the most comprehensive coverage, the answer is either Medigap Plan F or Plan G.

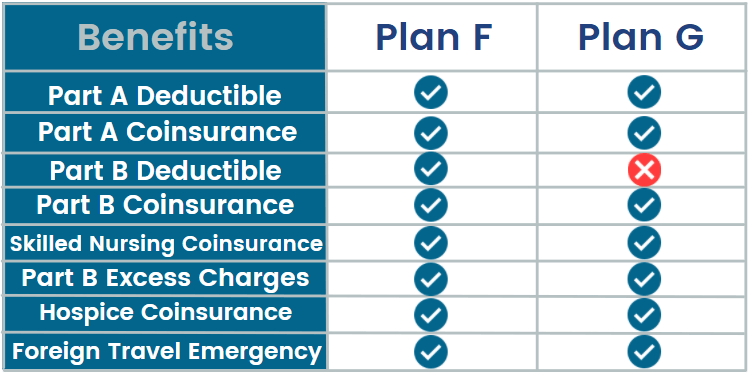

Benefits of Medicare Supplement Plans F and G

The two most popular Medigap plans are Plans F and G. These two plans are extremely similar, but there is one difference in their coverage.

Both plans F and G cover:

- Part A deductible

- Part A coinsurance (plus 365 extra days)

- Part B coinsurance/copays

- 3 pints of blood

- Skilled nursing coinsurance

- Part B excess charges

- Foreign travel exchange (up to plan limits)

The difference lies in the Part B deductible, which is $233 in 2022. Plan F will pay that deductible, while Plan G will not. So that one difference means that Plan F has slightly better coverage. But is it the best plan?

The Plan G Advantage

We’ve established that Medigap Plan F has slightly more coverage, but there are two other considerations.

First, Plan F is only available to those who turned 65 before January 1, 2020. Changes were made to the federal Medicare program that does not allow newly-eligible Medicare beneficiaries to enroll in a plan that includes coverage for the Part B deductible, which Plan F does. If you turn 65 on or after January 1, 2020 you will not be eligible to enroll in Plan F, making Plan G the most comprehensive plan for you. That may not be such a bad thing!

The second thing to consider with Plan F is that because it includes more coverage, it will also come with a higher price tag. We often find that the increase in monthly premiums between Plan F and Plan G are far more than the $233 that it saves you in the Part D deductible.

For example, the average premium for Plan F is between $140-$240. If we assume you can get a premium on the lowest end, your annual premium would be $1,680. The average premium for Plan G is between $110-$210. Again, assuming the lowest premium, your annual fee would be $1320. The annual difference between the two plans is $360.

In this example, you would save $127 with Plan G, even if you had to pay the Part B deductible.

How to Choose the Best Medicare Supplement

When choosing a Medicare supplement, you will have to weigh the coverage and the premiums. There is no “one-size-fits-all” when it comes to Medicare products, so there really is no “best” plan. The “best” Medicare supplement is going to be the one that fits your needs and your budget.

When choosing a Medicare supplement, you will have to weigh the coverage and the premiums. There is no “one-size-fits-all” when it comes to Medicare products, so there really is no “best” plan. The “best” Medicare supplement is going to be the one that fits your needs and your budget.

The easiest way to decide which Medicare supplement is right for you is by working with a licensed insurance agent. An agent will get to know you and your needs and then make a recommendation based on that information.