When you come into Medicare, your first decision is which way you’re going to go. Are you going to stay with Original Medicare, or are you going to choose a Medicare Advantage plan. It’s a huge decision and one you absolutely need to understand. I’m going to tell you right now why I would never choose a Medicare Advantage plan, and I’ll show you exactly why and the difference between the two.

What is Medicare Advantage?

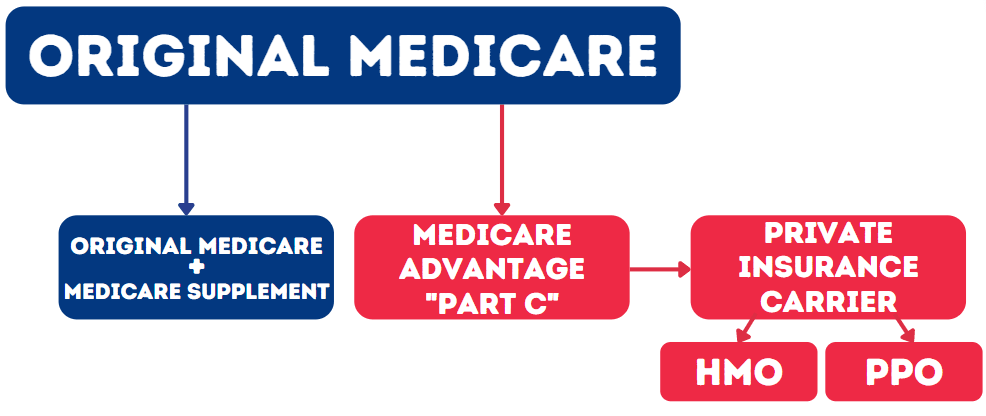

I’m going to tell you exactly why I, personally, would never choose a Medicare Advantage plan. First, we need to understand what a Medicare Advantage plan is. It really should be called Medicare Managed Care because that’s exactly what it is. If you choose to enroll into a Medicare Advantage Plan, it takes you out of Original Medicare, and put you into a private insurance carrier’s managed care plan. Now how does that work and why does the cost not reflect that to you?

Medicare actually pays a managed care plans to take responsibility of all your medical claims. Medicare pays generally upwards of about $1,000 per month, per member to the Medicare Advantage company to take your claim responsibility away from Medicare. This is good for Medicare and good for the Medicare Advantage company because they want as many people as possible enrolled into these plans, which is why you see so many commercials every year.

When you go into a Medicare Advantage plan, you are going into a managed care plan, which used to always be called HMO, which is a health maintenance organization.

Difference Between Original Medicare and Medicare Advantage

Cost

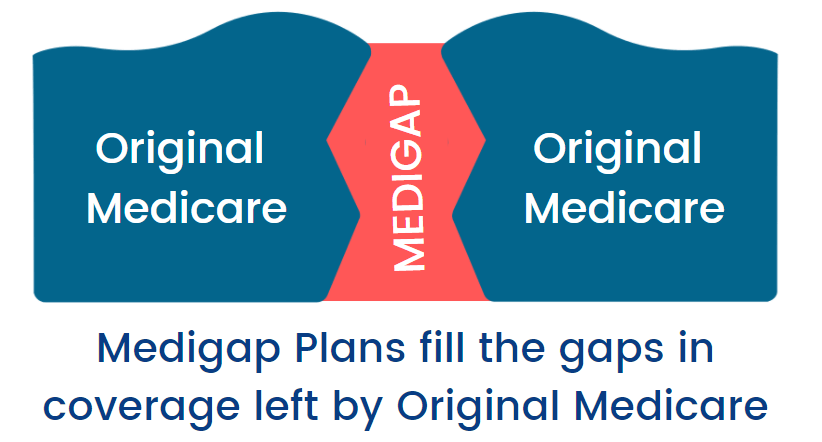

Let’s first talk about the cost differences between a Medicare Advantage plan and staying on Original Medicare. If you stay on Original Medicare Parts A and B, you will likely have a Medicare Supplement plan that covers the pieces that A and B do not. Medicare Part A has a large deductible and Medicare Part B has a smaller deductible. There is also a 20% co-insurance with Part B that you wouldn’t want to be responsible for. You would get a Medicare Supplement plan that covers most of those gaps, except for the Part B deductible. Most Medigap plans are around $100 monthly, which is not cost prohibitive in most areas.

Something to understand, whether you’re on Original Medicare or on a Medicare Advantage plan, is that you are always going to have to pay your Medicare Part B premium. The Part B premium, which in 2022 is $170.10 per month, is going to be paid regardless of which avenue you choose. That really negates the difference between the choices because it is always there. Other than monthly premium, the other cost with a Medicare Supplement plan in your Medicare part D drug plan. These plans are as low as $7 monthly, and benefits are different based on your specific drug regimen.

A Medicare Advantage plan, however, can have a $0 monthly premium. It can also have $50 per month premium, or even higher based on the plan The plan will also generally will include the prescription drug coverage within the plan.

If you are looking at Medicare Advantage plans, it is important to see that the lower the cost is, generally the more restrictive the plan will be, or the smaller network of doctors and hospitals. Essentially, you get what you pay for without a doubt.

When you go to use either Original Medicare with a Supplement, or a Medicare Advantage plan, it is usually significantly less expensive with Original Medicare and a Supplement. When you have a supplement, such as Plan G, your out of pocket is a just couple hundred bucks for the entire year! Once you’re out of pocket the Medicare Part B deductible, your Plan G pays 100% the rest of the year without any out-of-pocket expense.

With Medicare Advantage it’s more of a pay-as-you-go plan, and your out-of-pocket maximum for the year can be as high as $7,500. It can be a little bit less expensive on the front end, but can be significantly more expensive as you use your plan. If you never use your plan, it’s terrific! Generally where you hear the good things about Medicare Advantage plans are the people that haven’t had a lot of experience using them.

Coverage

When it comes to Medicare Supplements, there is really no interaction between the enrollee and the insurance company. Essentially you go to the doctor, you give them your Medicare card and your supplement card, the doctor bills Medicare, Medicare pays their part and sends the rest to the Medicare supplement company. That’s it! The Medicare Supplement company has no decision to make on what they cover or do not cover. If Medicare covers something, the Medigap has to cover it as well. This means that there is no interaction between you and the insurance company. There are any pre-authorizations, referrals, or anything of that nature with original Medicare.

This the primary reason that I would absolutely choose Original Medicare and would never choose Medicare Advantage. I want control over what I do, and Medicare Original gives you that control. It is basically autonomous. If something is medically necessary and your doctor says you need it, Medicare covers it. Then, your supplement has to cover it because they are required to cover whatever Medicare covers. There’s literally no decision made.

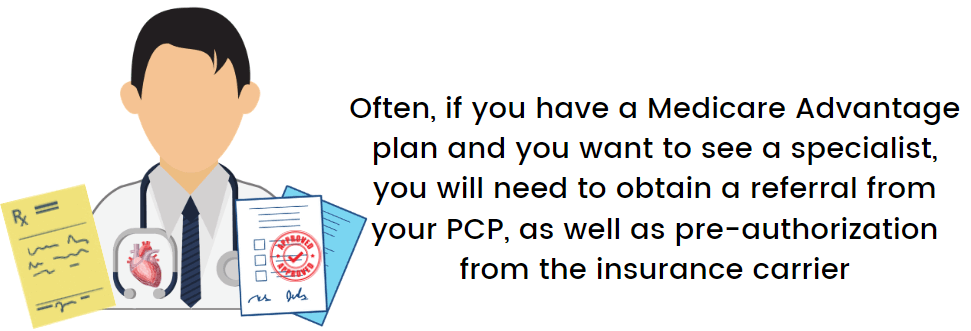

With a Medicare Advantage plan – different story. First, there are pre-authorizations. If you’re going to have something medically significant completed, generally you will have to have it pre-approved first. The pre-approval process can cause wait times of days, weeks, and even months. Not just the pre-approvals, but also authorizations and referrals. Needing referrals from a primary to a specialist is probably the number one complaint with a Medicare Advantage plan. If you need to go to a specialist and you have a Medicare Advantage HMO plan, first you have to go to your primary care physician to ask them if it’s okay, then they give a referral to make an appointment with a specialist. This entire process can add weeks to the time it takes for you to see a specialist! With Original Medicare, none of that happens! Now, there are sometimes with Original Medicare that a specialist may require that you see a family doctor before you see them, but it would be a requirement of that specialist, not Medicare.

Networks

Networks are probably the number two complaint on Medicare Advantage. When you join a Medicare Advantage plan you will primarily have to use a network of doctors and hospitals that are based on your zip code, known as your service area. Just like with services, it can be cost related. If it’s a $0 premium plan that you’re in, you will probably have a much smaller choice of doctors and hospitals. If you’re paying $50-80 per month in premium, you may have a bigger network of doctors and hospitals, but still in your plan’s service area. If you are traveling and you run into a medical scenario and it’s an emergency, the hospitalization is going to be covered as long as it is an emergency service. However, you can still be in the hospital or require continued care and no longer constitute emergency services.

With Original Medicare, you can go see any doctor or hospital anywhere in the country, that accepts Medicare. If you want to choose to go to a specialist for your very unique situation in New York, or in California, you simply make the appointment and do it. You don’t have to get any pre-authorization. On a Medicare Advantage HMO plan you cannot do that. There are some Medicare Advantage plans that will have out-of-network benefits that will allow you to go other places, but the plan is typically cost prohibitive. The reason for this is that the out-of-network doctor can charge whatever they want to charge because they have no pre-negotiated rates with an insurance company, and the Medicare Advantage plan would have to pay based on usual and customary. What the plan pays could be far less than what that doctor actually is charging, and you end up paying that balance bill after the usual and customary part of it is taken care of.

With Medicare Original, it’s all already pre-negotiated. Doctors who accept Medicare agree to Medicare-approved charges, and your supplement doesn’t play into any of the decision making. You go to the doctor, you give them your Medicare card, they send the claims to Medicare – Medicare then sends the balance to the supplement that they’re supposed to pay and that’s it! There’s no questions asked. I have thousands of clients on Medicare supplements and I get zero customer service calls – literally zero! If I get a call it’s about a lost card or something like that but never… I mean I can’t recall last time that somebody said hey this didn’t get paid and this is a problem it just doesn’t happen!