Are you asking yourself, “What are the cost of Medicare 2024?” You’re not alone. As the new year rolls around, understanding the ins and outs of Medicare costs is becoming increasingly important for millions of Americans. Whether you’re approaching age 65 or already running through your Medicare benefits, staying up-to-date with the latest changes can help you better budget your health care. In this blog, we’ll break down the costs associated with Medicare in 2024, to make it easier for you to understand what to expect and how to manage healthcare costs.

Let’s start with Medicare Part A: Hospital Insurance

Most people pay nothing for Part A, as it is generally covered by payroll taxes during your working years. But if you don’t raise enough business money, you’ll have to pay a fee:

0-29 Employment rate: $506 per month

30-39 Employment rate: $278 per month

There are other costs to consider beyond the fees:

Inpatient deduction: $1,632 per benefit period

Provision of coinsurance

Days 1-60: $0 per day

61-90 days: $408 per day

91 Days And Over: $816 per day (up to 60 days of lifetime deposit)

Medicare Part B: Medical Insurance

Part B includes outpatient care, doctor visits, and other treatments. Unlike Part A, almost everyone pays a premium in Part B. The premium in 2024 is $174.70 per month. However, if your income exceeds a certain limit, you will pay more, called the Income-Related Monthly Adjustment Amount (IRMAA).

Here’s a quick look at the Part B costs

Deductible: $240 per year

Coinsurance: After meeting the deductible, you typically pay 20% of the Medicare-approved amount for most services.

Medicare Part C: Medicare Advantage

Medicare Advantage plans (Part C) are offered by private insurance companies and combine Part A and Part B coverage. Many plans also offer prescription drug coverage (Part D). Costs for Medicare Advantage plans vary widely based on the plan and provider. On average, expect to pay around $18 per month in premiums, but some plans may offer premiums as low as $0.

Remember, with Medicare Advantage, you may have additional costs like copayments, coinsurance, and deductibles, which differ from plan to plan.

Medicare Part D: Prescription Drug Coverage

Part D helps cover the cost of prescription drugs. Premiums for Part D vary depending on the plan you choose and your location. The average monthly premium for a Part D plan in 2024 is about $33. Again, higher-income individuals may pay more due to IRMAA.

Additionally, you’ll need to consider

Deductibles: Vary by plan but can’t exceed $545 in 2024

Copayments/Coinsurance: These costs also vary by plan and the specific medications you need.

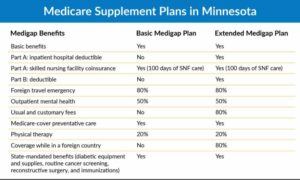

Medigap: Supplemental Insurance

Medigap plans help cover out-of-pocket costs not paid by Original Medicare (Parts A and B). These plans are sold by private companies, and the costs can vary based on the plan you choose and your location. Premiums for Medigap policies can range from $50 to several hundred dollars per month.

Keeping Costs in Check

To make the most of your Medicare benefits and keep costs manageable

- Review your plan annually: Your health needs and the plans available to you can change yearly. Make sure your plan still fits your needs.

- Consider extra help: Programs like Medicaid or the Medicare Savings Programs can help cover some costs if you have limited income.

- Stay informed: Changes to Medicare happen frequently. Keep up with the latest updates to avoid unexpected expenses.

Medicare can be complex, but understanding the costs for 2024 will help you plan better and potentially save money. As always, compare your options, seek advice if needed, and make the choice that best suits your health needs and financial situation. Here’s to a healthier and more financially secure 2024!

Read more: Turning 65 Medicare Leads

Conclusion

Understanding “What Is The Cost Of Medicare 2024” is essential for making informed decisions about your healthcare. With various parts and plans to consider, knowing the latest premiums, deductibles, and out-of-pocket expenses helps you plan your budget effectively. Stay updated, review your options annually, and seek assistance if needed to ensure you make the best choices for your health and financial well-being. Here’s to navigating Medicare with confidence and peace of mind in 2024!