Navigating Medicare choices can feel like solving a puzzle, especially with all the parts and policies available. When approaching Medicare eligibility, you should ask, “What are your Medicare options?”. In a nutshell, understanding these strategies can help you make informed decisions that best suit your health needs and budget. Let us break down your Medicare options and clear up any confusion so you can choose the right plan for your golden years.

First Is the Original Medicare

Original Medicare is a traditional program offered directly through the federal government and consists of two main components:

Part A (hospital insurance): This includes hospital stays, skilled nursing care, hospice care, and some home health care If you have worked for at least ten years and paid Medicare taxes, it may not be required if you pay Part A fees.

Part B (Medical Insurance): This covers a physician’s practice, outpatient services, medical supplies and preventive care. Part B includes monthly payments, which can vary depending on your income.

Original Medicare allows you to see any doctor or specialist who accepts Medicare. However, it doesn’t say anything. For example, it generally does not cover prescription drugs, routine dental checkups, vision or hearing.

Medicare Advantage (Part C)

Medicare Advantage plans are an alternative to Original Medicare offered by private insurance companies approved by Medicare. These plans combine Part A and Part B coverage and often include additional benefits like prescription drug coverage (Part D), and dental, vision, and hearing care. Some plans might even offer wellness programs and gym memberships.

Medicare Advantage plans can come with lower out-of-pocket costs compared to Original Medicare. However, you’ll typically need to use the plan’s network of doctors and hospitals, and you may need referrals to see specialists.

Medicare Prescription Drug Plans (Part D)

If you stick with Original Medicare and need prescription drug coverage, you can sign up for a separate Medicare Prescription Drug Plan (Part D). These plans are also offer by private insurance companies and vary in cost and coverage.

Each plan has a list of covered drugs, known as a formulary, and different plans may cover different drugs. It’s important to choose a Part D plan that covers the medications you need at a cost that fits your budget.

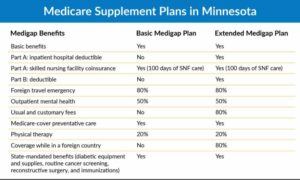

Medicare Supplement Insurance (Medigap)

Medigap plans are sold by private companies to fill the gaps in Original Medicare. They can help pay for out-of-pocket costs like copayments, coinsurance, and deductibles. Some Medigap plans also offer coverage for services that Original Medicare doesn’t cover, such as medical care when you travel outside the U.S.

Medigap plans don’t work with Medicare Advantage Plans. If you have a Medicare Advantage Plan, you can’t also have a Medigap plan.

Making Your Choice

Choosing the right Medicare plan depends on your health needs, budget, and preferences. Here are a few things to consider:

Budget: Look at the premiums, deductibles, and out-of-pocket costs. Original Medicare can have higher out-of-pocket costs unless you get a Medigap plan. Medicare Advantage plans may have lower out-of-pocket costs but may charge more in premiums.

Coverage Needs: Consider whether you need additional benefits like prescription drugs, dental, vision, or hearing coverage. Medicare Advantage plans often include these, while Original Medicare doesn’t.

Doctor and Hospital Access: If you have preferred doctors and hospitals, make sure they’re covered under the plan you choose. Original Medicare gives you access to any doctor who accepts Medicare, while Medicare Advantage plans typically have network restrictions.

Travel: If you travel frequently or spend part of the year in another state, Original Medicare or a Medigap plan may offer more flexibility.

Read more: What Is The Best Medicare Supplement Plan For 2024

Conclusion

In summary, understanding Medicare doesn’t have to be overwhelming. By breaking down the options and considering your individual needs, you can make a well-informed decision about your healthcare. Whether you choose Original Medicare, Medicare Advantage, a Prescription Drug Plan, or a Medigap policy, knowing the pros and cons of each helps you navigate your choices with confidence. Remember, the question “What are your Medicare choices?” explained thoroughly, is essential to ensuring you receive the best possible care. Take the time to explore your options, and you’ll find a plan that works for you.