The Medicare cost increases have just been released for 2022. Every year there are projections as to what the new Medicare premiums and deductibles will be for the following year. Once November hits, CMS, the Center for Medicare and Medicaid Services, releases the actual cost of Medicare numbers. This year, the projections were very different from the released costs, and not in a good way! The new Medicare premiums and deductibles are much higher than what was predicted, and it is important to know how these new costs may impact you.

Social Security Cost-of-Living Adjustment Increase

Let’s start with the good news! About a month ago, if you are on Social Security, you might have heard that your benefit is getting a pretty nice bump- one of the biggest bumps in a long time. The Social Security Cost-of-Living Adjustment is increasing by 5.9%. This means that if you are currently drawing Social Security benefits, your benefit amount will be increase by 5.9% in the year 2022. Unfortunately, if you are also on Medicare, part of that increase is going to be devoted to the increase in your Medicare Part B monthly premium.

Let’s start with the good news! About a month ago, if you are on Social Security, you might have heard that your benefit is getting a pretty nice bump- one of the biggest bumps in a long time. The Social Security Cost-of-Living Adjustment is increasing by 5.9%. This means that if you are currently drawing Social Security benefits, your benefit amount will be increase by 5.9% in the year 2022. Unfortunately, if you are also on Medicare, part of that increase is going to be devoted to the increase in your Medicare Part B monthly premium.

Medicare Part B Premium

Medicare Part B covers your outpatient costs on Medicare. You will pay a monthly premium for Medicare Part B whether you have only Original Medicare, a Medicare Supplement plan, or a Medicare Advantage plan. If you are drawing Social Security benefits, the premium will be taken directly from your monthly check. If you are not drawing your Social Security benefits, you will be billed directly every quarter.

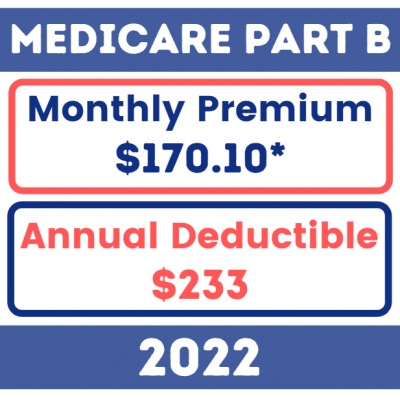

In 2021, the standard Medicare Part B premium was $148.50. The standard Medicare Part B premium for 2022 is going to be $170.10, which is an increase of $21.60. This increase is definitley higher than the increases we have seen in the past, which typically range from $5-10.

Medicare Deductibles

The other cost related to Medicare that are increasing are the Medicare

Medicare Part B Deductible

This is a deductible that is paid on a annual basis before Medicare will begin to cover any outpatient expenses. Luckily, it is a small deductible, especially in comparison to the deductibles you find on most group health insurance plans, but it is increasing. In 2021, the Medicare Part B deductible was $203 annually. In 2022, the Medicare Part B deductible is going to be $233 annually, which is an increase of $30.

Medicare Part A Deductible

Unlike the Medicare Part B deductible, the Medicare Part A deductible is not an annual deductible. Rather, this deductible is charged per benefit period. This means that you could find yourself paying your Part A deductible multiple times a year based on circumstance. If you go 60 or more days between hospitalizations, the deductible will reset. In 2021, the Medicare Part A deductible was $1,484. In 2022, the Medicare Part A deductible is going to be $1,556, which is an increase of $72. Luckily, the majority of Medicare Supplement plans cover the Part A deductible, so most people will not see themselves paying this $1,556 out-of-pocket. However, if you do not have a Medigap plan, you want to be aware of this deductible, as it is a substantial amount of money.

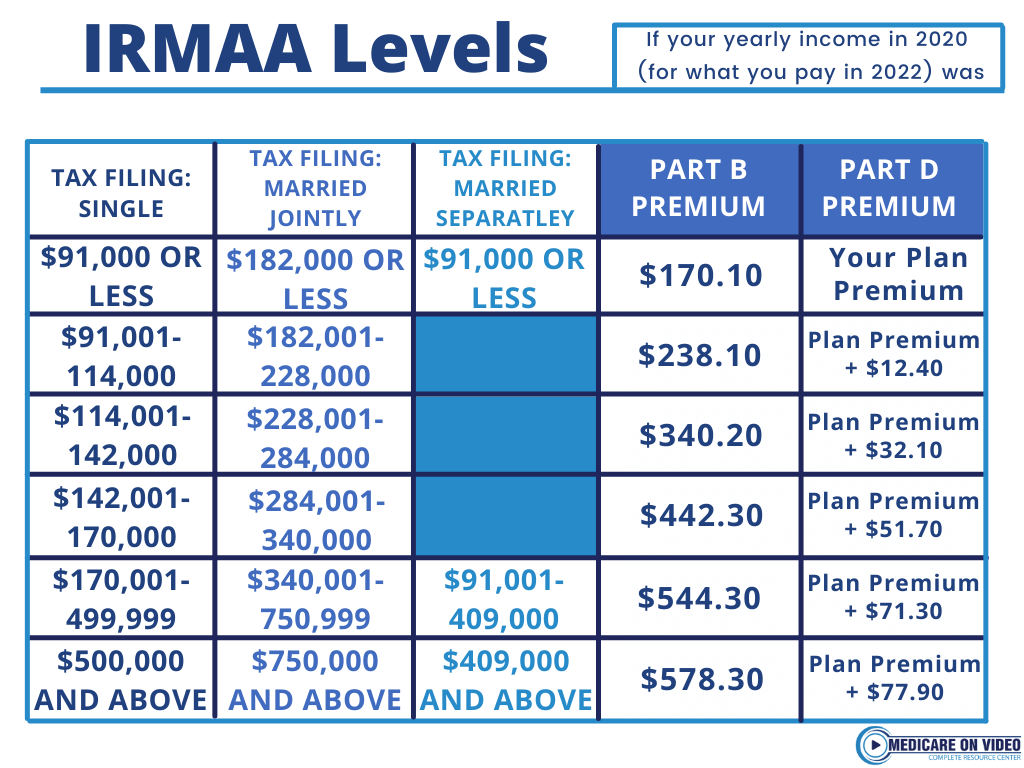

IRMAA

Although the 2022 premium for Medicare Part B has been announced as $170.10, that is not the Part B premium for everyone. If your gross income level is above a specified amount, both your Medicare Part B and Part D premiums will be increased based on the level. This increase is called the Income Related Monthly Adjustment Amount (IRMAA). Your IRMAA level is based on the most recently available tax return, which is typically from two years prior. IRMAA is based on your gross income which includes all income such as salary, inheritance, estate sales, etc.