Maine Medicare Plans

Maine has a rugged coastline like Acadia National Park with larges forests and lakes. Lighthouses, seafood restaurants and even the occasional cruise ship can be seen in this lush and beautiful state. Don’t forget the sandy beaches and set sail to go whale watching off the harbors. Maine is a state like no other.

One of the things that makes Maine so different from other states involves the rules regarding Medicare! Many of the Medicare plans you will find in Maine will have special enrollment periods for both when you first enroll into a MediGap plan, as well as if you want to change that plan in the future.

What are the Most Popular Medicare Supplement Plans in Maine?

- Medicare Supplement Plan F

- Medicare Supplement Plan G

- Medicare Supplement Plan N

When is the Open Enrollment Period in Maine?

As a Medicare beneficiary, you can enroll in any Medicare Supplement within your first six months of your Medicare Part B effective date, set by the Centers for Medicare and Medicaid Services, also known as CMS. This is considered your open enrollment period.

Both Medicare Part A and Part B effective date.  During this time, insurance carriers are required to approve your MediGap application, and are prohibited from declining the coverage you need because you have a pre-existing condition. You can still apply outside of this window, but you will be required to go through medical underwriting, and could be denied coverage based on your health history.

During this time, insurance carriers are required to approve your MediGap application, and are prohibited from declining the coverage you need because you have a pre-existing condition. You can still apply outside of this window, but you will be required to go through medical underwriting, and could be denied coverage based on your health history.

MediGap Plan A in Maine

Insurance carriers are required to offer Medicare Supplement Plan A once per year for anyone to apply for, regardless of health history. This is known as guaranteed issue period. There is a catch, however. The insurance carriers are given the option to choose which month of the year to offer this enrollment. Luckily, insurance carriers must accept you into a Plan A during that month, but Plan A is your only option if you use this guaranteed issue rule in Maine.

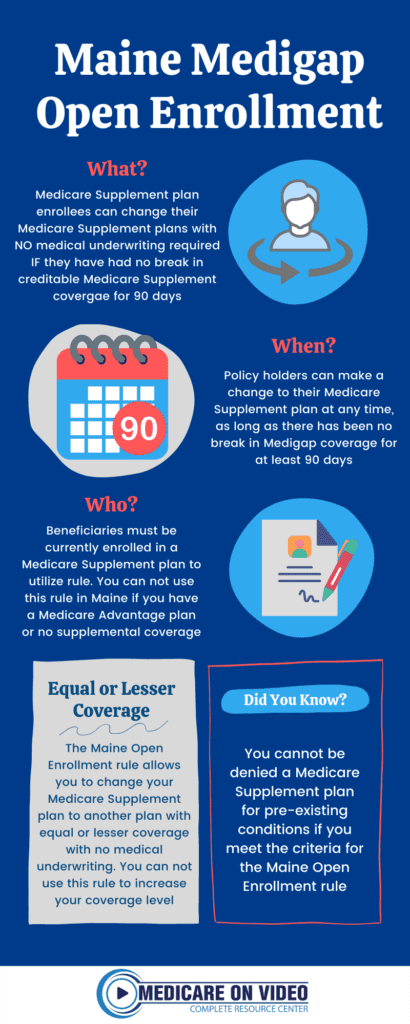

Can I Change Medicare Supplement Plans in Maine?

Applying to change Medicare Supplement plans in Maine is dependent on whether you are currently enrolled in a MediGap plan, or not. This rule is all based on what is called creditable coverage. If you are currently enrolled in a Medicare Supplement plan in Maine and have never gone more than 90 days without loss of coverage, you can change your MediGap plan to one of equal or lesser value with no medical underwriting. Essentially you can move from a Plan F down to a Plan G or Plan N, but cannot use this rule to move up in coverage (i.e. from a Plan N to a Plan G). This ability to change with no medical underwriting is extremely beneficial if you have any pre-existing conditions that may be declinable.

If you are looking to increase the benefits of your plan (move up in coverage), or enroll into a MediGap plan for the first time, you will be subjected to medical underwriting if you are more than 6-months past your Medicare Part B effective date.

This means that insurance carriers are given the ability to assess your health history, prescriptions, height and weight, as well as other health-related factors to determine if you will be approved or denied coverage. During medical underwriting, insurance carriers have the ability to deny a Medicare Supplement plan application based on pre-existing conditions, so it is important to enroll in a MediGap plan during your open-enrollment period to guarantee your acceptance.

This means that insurance carriers are given the ability to assess your health history, prescriptions, height and weight, as well as other health-related factors to determine if you will be approved or denied coverage. During medical underwriting, insurance carriers have the ability to deny a Medicare Supplement plan application based on pre-existing conditions, so it is important to enroll in a MediGap plan during your open-enrollment period to guarantee your acceptance.

Medigap Plan F in Maine

Medicare Supplement Plan F has been a very popular plan with Medicare beneficiaries over time. The reason for the popularity of Plan F, is that it covers the gaps left by Medicare with no deductibles or copayments. This means that Medicare Part A and B costs are covered with no additional out-of-pocket. However, if you became Medicare eligible after January 1st 2020, you are not eligible to enroll in MediGap Plan F. Luckily, there are other great Medicare Supplement plan options available.

Medigap Plan G in Maine

Medicare Supplement Plan G is a very comprehensive Medicare Supplement plan with very little out-of-pocket expense. Once you have met your Part B annual deductible, MediGap Plan G becomes a full  coverage plan, covering all of the gaps left by Original Medicare, with no additional out-of-pocket expenses. Plan G is typically a very cost-efficient plan with an affordable monthly premium to ensure gold-standard coverage.

coverage plan, covering all of the gaps left by Original Medicare, with no additional out-of-pocket expenses. Plan G is typically a very cost-efficient plan with an affordable monthly premium to ensure gold-standard coverage.

Medigap Plan N in Maine

Medicare Supplement Plan N is also a great, comprehensive MediGap plan available in Maine. This plan has slightly more out-of-pocket cost than MediGap Plan G, but also comes with a lower monthly premium. As with Plan G, you are still responsible for the Medicare part B annual deductible. Once you have met this deductible, your Original Medicare coverage kicks in, but you still have some cost-share. With MediGap Plan N, you will pay copayments up to $20 for office visits, and up to $50 for ER visits that do not result in an inpatient admission. Plan N also has the possibility of an excess charges if you use a doctor or healthcare provider that does not accept Medicare Assignment. Excess charges can be up to 15% of the Medicare-approved payment. If the monthly premium difference between Plan G and Plan N is large enough, Plan N is often times a very attractive option for your Medicare Supplement plan.

What is the Cost of a Medicare Supplement Plan in Maine?

Monthly premiums for Medicare Supplement plans are based on three main factors- age, gender, and location. There are other things that may impact your premium such as tobacco use. The premium amounts will vary based on these factors, so it is important to receive a quote based on your specific demographic information.

Medicare Plans in Maine for Those Under 65

When it comes to Medicare in Maine, there is no offered open enrollment for MediGap plans required by the state for those under 65. You’ll be required to go through and pass any  medical underwriting that is necessary for acceptance. If you’re under 65 and disabled but still qualify for Medicare, you may not pass this underwriting. If you fit within this category, there are Medicare Advantage Policies that you can look into.

medical underwriting that is necessary for acceptance. If you’re under 65 and disabled but still qualify for Medicare, you may not pass this underwriting. If you fit within this category, there are Medicare Advantage Policies that you can look into.

Once you reach 65, more Medicare supplement plans will open up for enrollment in Maine without any health questions. This period guarantees acceptance.

Medicare Advantage in Maine

Maine also offers options for Medicare Advantage plans. In these plans you must live in your plan’s service area and enroll during an appropriate election period. Medicare Advantage plans do not required medical underwriting if enrolling during an election period, but are also significantly different plans than Medicare Supplement plans.

Medicare and Medicaid in Maine

It is possible to qualify for both Medicare and Medicaid in the state of Maine. These two programs, however, are separate and have different qualifications you must meet in order to receive benefits. To qualify for Medicaid, you must meet Alabama’s state income requirements. To qualify for Medicare, you must be either over the age of 65, or under 65 but receiving Social Security Disability Insurance for a minimum of 24 months before applying for Medicare.

Download Our Free ebook.

Click the image below for instant access.

In his book “Medicare Made Clear” the #1 authority on Medicare, Keith Armbrecht outlines all you need to know when starting medicare. Easy to follow with videos included. Download Now for Free!