When Can I Change My Medicare Supplement Plan?

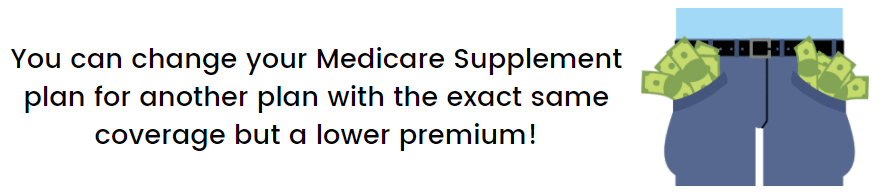

If you are enrolled in Original Medicare with a Medigap plan, you may be wondering how and when you can change your plan. Whether you are looking for a plan with more or less coverage, or want to remain on the same plan but lower your premium, it is always a great idea to shop your plan each year to see what is available to you.

Unlike Medicare Advantage Plans or Medicare Part D plans, Medicare Supplement plans do not follow the Annual Election Period (open enrollment) timeline for being able to switch plans. Rather than having to wait until October each year, you can actually shop your Medigap plan any month of the year! That’s right, you can enroll and disenroll from Medicare Supplement plans during any month of the year without having to wait until open enrollment. Truth be told, you want to shop your plans during the months of the year that do not include open enrollment, as things tend to move faster January-September!

Why Should I Change My Medicare Supplement Plan?

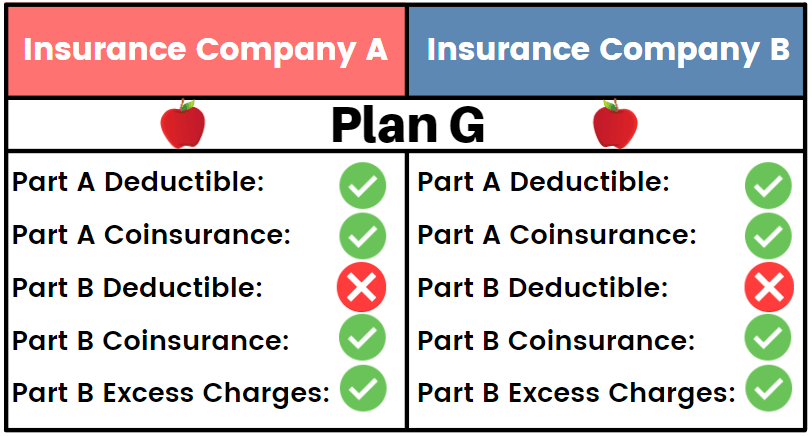

The answer is simple, to save money! Medicare Supplement plans are completely standardized, as well as regulated both at the state and federal level. This means that essentially a Plan G with one insurance carriers offers identical benefits to a Plan G with another insurance carrier. The insurance companies are not able to offer the core benefits offered by Medigap plans, as those benefits are set by CMS.

The difference between plans that insurance carriers can control is the monthly premium. Each insurance carrier is able to set the premium for the Medigap plan they offer, as well as the premium increases over time as you age in the plan. This means that although two Plan G’s may have the same benefits, they most likely do not have the same cost! It is extremely important to shop your Medicare Supplement plan annually to see if there are any monthly premium savings to take advantage of to lower your medical costs throughout the year.

Call us at 877-885-3484 for a free quote on the Medicare Supplement plan options available in your area!

Can I Change Medigap Plans with Pre-Existing Conditions?

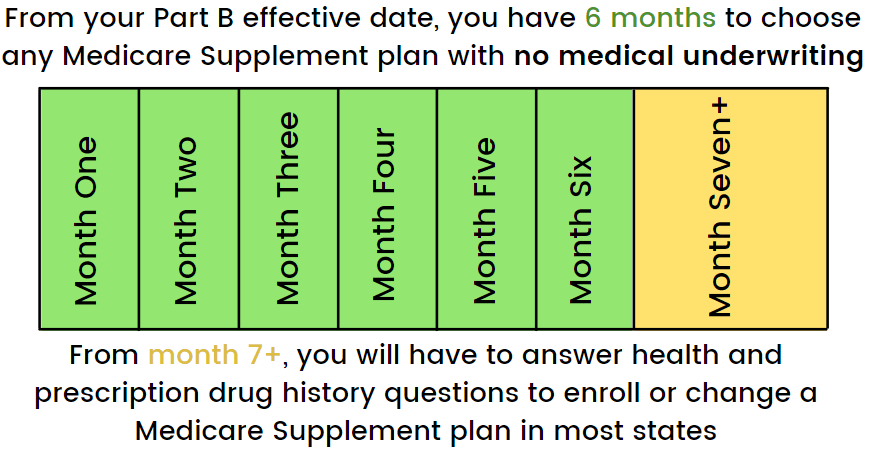

When you first enroll in Medicare, you are given effective dates for your Medicare Part A and your Medicare Part B. For Medicare Supplement plans, the Part B effective date is extremely important. This effective dates starts a 6 month long clock where you are able to enroll into any Medicare Supplement plan that you want with absolutely no health or prescription drug questions. Essentially, you are guaranteed acceptance into any plan with any insurance company regardless of your health history. This is extremely beneficial if you have any pre-existing health conditions.

Once you reach month 7 past your Medicare Part B effective date, things shift. At this point, insurance carriers have the ability to require applicants to undergo medical underwriting (in most states, see our Medicare Plans by State page for information on your specific state’s guidelines).

Medical underwriting is a process in which the insurance carrier can assess your health, prescription, and hospitalization history. This process typically involves answering questions about specific health conditions, submitting a list of current and past (within 2 years) prescriptions, and detailing any hospitalizations usually within the last 5 years. The insurance carrier also has access to most of this information through Medicare, so it is crucial to answer all medical underwriting questions accurately.

The medical questions asked on the Medigap application are up to the insurance carrier’s discretion, however, the majority of carriers look for similar pre-existing diagnoses as disqualifiers. Here is a compiled list of sample medical questions you may see on an underwritten Medicare Supplement application. It is important to note that these are not all of the questions that can or will be asked, but an example of what you may need to answer.

Changing to a Medigap Plan from a Medicare Advantage Plan

If you are currently enrolled in a Medicare Advantage plan and want to change into a Medicare Supplement plan, you will need to wait until the Annual Election Period, which is from October 15- December 7th. The Annual Election Period (AEP), also known as open enrollment, is the time period when Medicare beneficiaries are able to enroll, disenroll, and change both Medicare Advantage plans and Medicare Part D plans.

If you are wanting to leave your Medicare Advantage plan, you would submit an application for a Medicare Supplement plan to begin on January 1st of the following year. If accepted and approved for the Medicare Supplement plan, you would then disenroll from your Medicare Advantage plan effective December 31st. You would also utilize AEP to enroll in a Medicare Part D plan to also begin January 1st, alongside your new Medicare Supplement plan. It is important to begin this application process as soon as possible, as this is the time of year that people enrolled in Medicare Advantage plans can make this switch, so insurance company underwriters are incredibly busy reviews applications, and the process can take weeks before you receive either an approval or denial.

Give us a call at 877-885-3484 and an experienced agent will walk you through the process of applying for a Medigap plan, as well as disenrolling from a Medicare Advantage Plan.