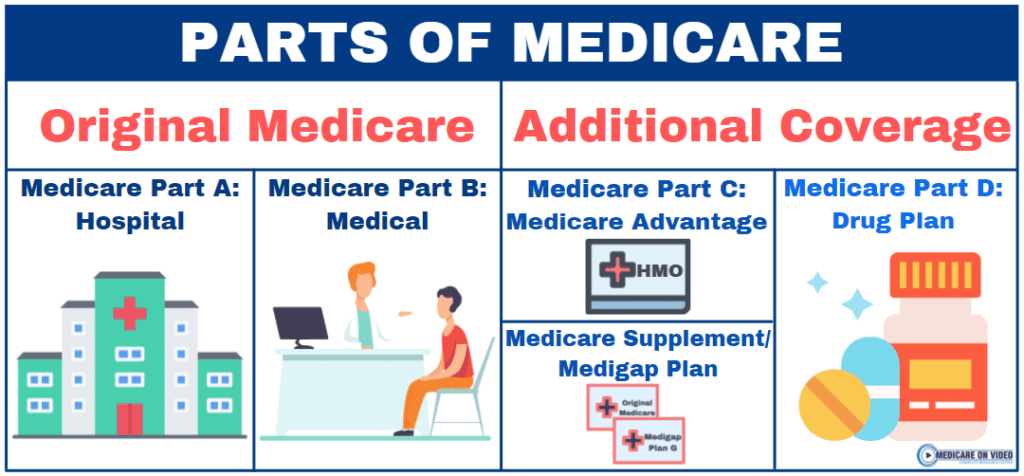

Before we get into the details of how to sign up for Medicare, it’s important to understand some basic information about how Medicare works and the available options. There are actually four different parts to Medicare. From these four main parts, you will have to make a decision regarding which parts to enroll in at what time. The four parts of Medicare are:

- Original Medicare (Part A & Part B)

- Medicare Supplements Plans

- Medicare Advantage Plans (Part C)

- Part D Prescription Drug Plans

How these different parts of Medicare work together (or don’t) and which you will choose to enroll in depends on your individual situation. There are several ways these options can be combined, which are listed below:

- Original Medicare (Part A & Part B) Only

- Original Medicare (Part A & Part B) and a Part D Prescription Drug Plan

- Original Medicare (Part A & Part B), a Part D Prescription Drug Plan, and a Medicare Supplement Plan

- Medicare Advantage Plan (Most of which also include Part D Prescription drug benefits)

If you enroll in a Medicare Advantage plan that plan completely replaces Original Medicare, you cannot be enrolled in a Medicare Advantage Plan and a Medicare Supplement plan at the same time. It is important to talk with an experienced independent Medicare agent to determine which Medicare program(s) are right for you.

There can also be penalties if you don’t enroll in Original Medicare or Part D when you are first eligible. It is important to know when these penalties may occur, as they are continuously accruing, and will last a life-time.

Medicare Sign Up Scenarios

- You are turning 65 in the next three months and are NOT getting benefits from Social Security or the Railroad Retirement Board.

In this scenario, you will need to sign up with Social Security to get Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You will not be enrolled into Medicare automatically.

To sign up:

- Apply online at Social Security. If you started your online application and have your re-entry number, you can go back to Social Security to finish your application.

- If you find yourself computer challenged check out this site: Cyber Seniors.

- Visit your local Social Security office. Call Social Security at 1-800-772-1213 (TTY: 1-800-325-0778).

- If you worked for a railroad, call the RRB at 1-877-772-5772.

- If you already have Part A and want to sign up for Part B, you can complete an enrollment application in Part B (CMS-40B).

About two weeks after you sign up for Medicare, you will get a “Welcome to Medicare” packet along with your red, white, and blue Medicare card. You’ll still have other important deadlines and actions to take, so read all of the materials in the packet.

- You already get benefits from Social Security or the RRB (or will be getting benefits at least four months before you turn 65)

You will be enrolled in Medicare Part A and Part B automatically when you’re first eligible and don’t need to sign up. If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.Medicare will send you a “Welcome to Medicare” packet along with your red, white, and blue Medicare card three months before you turn 65. You’ll still have other important deadlines and actions to take, so read all of the materials in the packet.

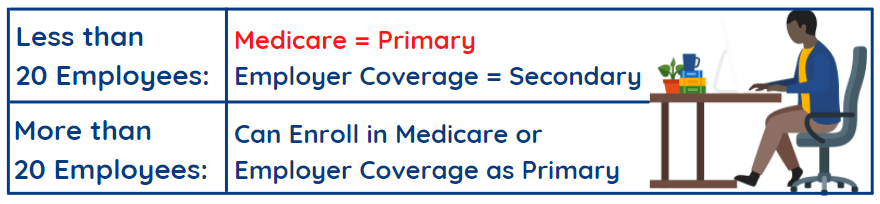

- You plan on continuing to work after you turn 65 and have health insurance coverage through your employer.

Depending on the employer’s size, you may be able to delay Part A and Part B without having to pay the penalty if you enroll later.- If your employer has fewer than 20 employees, you should sign up for Part A and Part B when you’re first eligible. In this case, Medicare pays before your employer group coverage. If you don’t enroll when you’re first eligible, you may have to pay a Part B late enrollment penalty, and you may have a gap in coverage if you decide you want Part B later.

- If your employer has 20 or more employees and provides creditable health care coverage (ask your employer’s benefits manager), you may be able to delay enrolling in Part A and Part B and won’t have to pay a lifetime late enrollment penalty if you enroll later.

To avoid a tax penalty, you should stop contributing to your Health Savings Account (HSA) at least six months before applying for Medicare.

- You are 65 (or older) and didn’t sign up for Medicare Part A and/or Part B when you were first eligible,

- You can sign up during the General Enrollment Period between January 1 – March 31 each year.

- You must pay premiums for Part A and/or Part B. Your coverage will start July 1.

- You may have to pay a higher premium for late enrollment in Part A and/or a higher premium for late enrollment in Part B.

- You have a special situation like a disability, End-Stage-Renal Disease or Amyotrophic Lateral Sclerosis (ALS), also called Lou Gehrig’s disease.

There are specific and detailed requirements for these types of situations, so talk with an independent agent experienced with Medicare to get more details about your particular situation’s enrollment requirements.

If you are continuing to work past age 65, or your spouse is continuing to work, you are not required to enroll in Medicare at age 65. In order to delay your Medicare enrollment without incurring penalties, you must have what is considered creditable health insurance. This means that your health insurance must be provided by an active employer-sponsored plan. Things such as COBRA and retiree insurance do NOT count as creditable coverage. If you do not have creditable coverage and delay your Medicare enrollment past at 65, you will be required to wait to enroll until the General Enrollment Period, and you will incur a late-enrollment penalty that will last the rest of your lifetime.

You can apply for Medicare through multiple different avenues. The easiest way to apply for Medicare is electronically through the Social Security website. If you submit an application electronically, you can track the progress through your My Social Security account. We have created an easy to use link that will take you directly to the Social Security website- www.startpartb.com

You can also call Social Security directly at 1-800-772-1213, or visit your local office to submit an application. Due to COVID-19, most local offices are working remotely, but may accept an application via fax.

Your Medicare Card

Your Medicare card has a Medicare number that’s unique to you but different from your Social Security Number to help protect your identity. If you did not receive your red, white, and blue Medicare card, there might be something that needs to be corrected, like your mailing address. You can update your mailing address by signing in to or creating your personal my Social Security account.

Your Medicare card has a Medicare number that’s unique to you but different from your Social Security Number to help protect your identity. If you did not receive your red, white, and blue Medicare card, there might be something that needs to be corrected, like your mailing address. You can update your mailing address by signing in to or creating your personal my Social Security account.

Four essential things to know about your Medicare card

- Your card is paper, which is easier for many providers to use and copy.

- If you’re in a Medicare Advantage Plan (like an HMO or PPO), your Medicare Advantage Plan ID card becomes your main ID card for Medicare.

- Only give your Medicare Number to doctors, pharmacists, other health care providers, your insurers, or people you trust.

If you forget your card, your doctor can often look up your Medicare Number online or if you are enrolled in a Medicare Advantage plan with your insurance company.