If you’re approaching 65 and retirement’s around the corner, you’re likely looking at healthcare options and planning for enrollment in Massachusetts Medicare. It is very important to understand the basic of Medicare in Massachusetts, as Massachusetts does things completely differently than the rest of the country!

Medicare On Video wants to make the process as easy as possible. As your go-to virtual assistant, we review everything you need to know to make the Medicare decision that’s best for you and your family — and to make sure you get everything right from the start.

Medicare Options in Massachusetts

Medicare is a health insurance program set up by the government to cover medical costs for individuals who qualify. Let’s chat about Medicare plans available to Massachusetts residents. These are some Massachusetts Medicare stats specific to 2021:

- Number of Massachusetts residents enrolled: 1,351,586

- Number of Medicare Advantage plans: 108 plans

- Number of stand-alone Medicare Part D plans: 27

- Number of Medigap plans types available in Massachusetts: 3

Original Medicare: Part A and Part B

You’re probably at least vaguely familiar with how Medicare plans are broken into different parts. Here’s a quick overview:

Medicare Part A covers in-hospital expenses like:

- Inpatient care

- Hospice care

- Nursing and facility

- Emergency room visits that require hospitalization

- Limited home health care

Medicare Part B covers services outside of the hospital, such as:

- Outpatient care

- Home health care

- Equipment

- Doctor visits

- Preventative care

- Physical therapy

- Doctor’s appointments

- Ambulance services,

- X-rays, blood work, and other tests

Medicare Advantage vs. Original Medicare in Massachusetts

A basic Medicare plan — also called “Original Medicare” — consists of Medicare Part A and Part B, and covers your bases for most healthcare expenses. These bases are not covered without some out-of-pocket, including deductibles and coinsurances. Also, what about hearing, vision, dental, and other routine necessities? You’ll notice some “gaps” within Original Medicare that you’ll want to address to give yourself the most appropriate and comprehensive coverage. This is where you’re going to look at options for either a Medigap (Medicare Supplement) plan, or a Medicare Advantage plan.

Every fall, just prior to Medicare enrollment, you’ve probably noticed a slew of commercials for Medicare Advantage plans. These plans are also known as Medicare Part C. Private insurance companies create plans that extend the benefits of Medicare to pick up the cost of prescriptions and other services which Original Medicare doesn’t cover. All Massachusetts residents with Medicare can elect to purchase a Medicare Advantage plan — including a plan with a $0 premium. But please read the fine print! These advertisements seem seductive, but you MUST consider the out-of-pocket maximums that a Medicare Advantage plan can command.

With an appropriate supplement, Medicare Original typically keeps your out-of-pocket max to around $300, whereas Medicare Advantage can soar to $7,550. Of course everyone’s needs and circumstances differ, and that $0 premium may work well for some people. We simply recommend you rigorously scrutinize both options before making your decision. Keep in mind that some Medicare Advantage plans are not available in every county, and many may limit your access to specific doctors and specialists.

Medicare Advantage plan providers in Massachusetts

- Aetna Medicare

- Blue Cross Blue Shield of Massachusetts

- Fallon Health

- Harvard Pilgrim

- Humana

- Lasso Healthcare

- Tufts Health Plan

- UnitedHealthcare

Medicare Supplement / Medigap Options in Massachusetts

As an alternative, a Medigap Supplement plan will often pick up the slack for Original Medicare and cover many of those crucial missing components. These plans differ in terms, costs, and benefits, so compare carefully and choose wisely. However, they almost always provide a more sensible arrangement than Medicare Advantage. The supplements will assist, to varying degrees, with copays, coinsurance, and deductibles not covered through Original Medicare.

These are some companies with options for Medigap plans in Massachusetts:

- AARP– UnitedHealthcare

- Blue Cross and Blue Shield of Massachusetts

- Fallon Health

- Harvard Pilgrim

- Humana

- Tufts

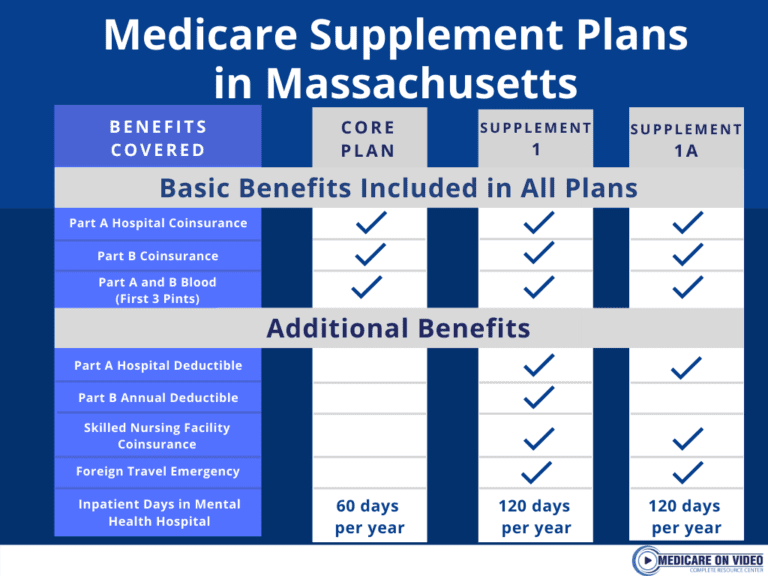

2021 Medigap Plans for Massachusetts Residents

- Medigap Core Plan

- Medigap Supplement 1 Plan

- Medigap Supplement 1A Plan

Additionally, you also have the option of purchasing Medicare Part D to covers all your prescriptions — including shots and vaccines. (D for drugs is handy way to remember this.) Prescription coverage includes, along with many others:

- Antidepressants

- Antipsychotics

- Anticonvulsants

- Antiretrovirals

- Immunosuppressants

- Anticancer

Understanding Medigap — Medicare Supplement Plans

While the rest of the country chooses between 12 Medigap plans standardized by the federal government, Massachusetts is one of three states with a different setup. The government’s 12 standardized plans are labeled Plans A through N. The Medicare Supplement plans have similar equivalents to those lettered plans.

In Massachusetts, the Core Plan option follows plan A. This plan covers coinsurance fees related to health expenses under Medicare Part A. The Core Plan will cover these expenses for 365 days beyond Original Medicare, including Part A coinsurance for hospice care. This plan does, however, involve more out-of-pocket that the other 2 plans available, such as the Medicare Part A and Part B deductibles. The Core Plan is considered the lowest tier supplement plan, covering the bare minimum of healthcare services outside of Original Medicare.

The second plan, Supplement 1, corresponds with Medicare Plan F. The Supplement 1 plan offers full coverage with no additional out-of-pocket for deductibles or coinsurance under Original Medicare. Because of changes in eligibility requirements, this plan will no longer be available to new Medicare beneficiaries after 2020.

The ideal option for maximal coverage and value is Supplement Plan 1A, which closely follows Medicare Plan G. Supplement 1A pays for of all the services provided by Original Medicare, with the exception of the Part B annual deductible. This means, the plan will cover inpatient hospital costs like blood transfusions, nursing, and hospice. The plan also takes care of coinsurances for doctor check-ups, lab tests, diabetes needs, x-rays, equipment, surgeries and other major expenses.

This is how you apply the benefits of Supplement 1A:

- Medicare pays first and covers 80 percent of expenses.

- After you’ve paid your annual deductible, Supplement 1A will pick up the remainder of the costs.

Because it pays all hospital expenses, including the hospital deductible, you wind up with a very large savings. When it comes to outpatient expenses, the supplement will cover all but the Part B annual deductible. Essentially you’re paying for your first doctor visit of the year, and Supplement 1A covers to the rest.

Another thing to keep in mind: most people prioritize travel during their retirement years. If you’re thinking of spending time abroad, you might be concerned about any medical costs you might incur while outside of the country. This supplement provides as much as $50,000 in foreign emergency care. Imagine the peace of mind you’ll experience vacationing in remote places without the fear of bankrupting yourself in the event of a major illness or accident. Medicare Advantage plans typically do not offer similar benefits.

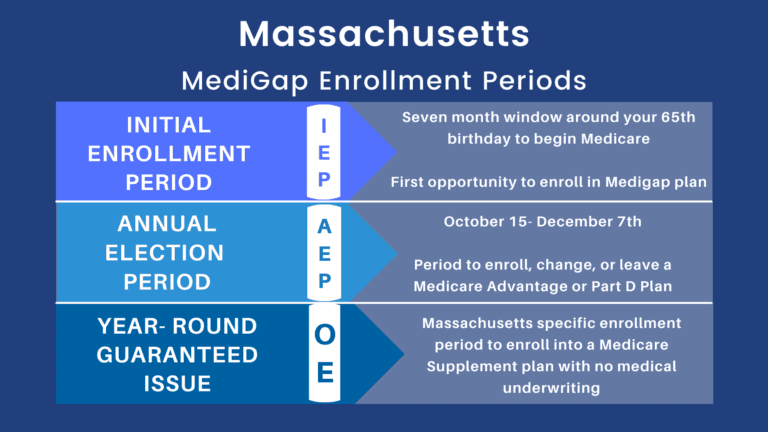

Massachusetts Medicare Supplement Enrollment Periods

In most states, Medicare beneficiaries are given a 6-month long open enrollment window to choose a Medicare Supplement plan with no health questions or medical underwriting. In Massachusetts, however, plans are what is known as guaranteed-issue all year long. Guaranteed-issue means that the Medicare Supplement plan companies are required to accept you into the Medigap plan you apply for, regardless of your health history. This is extremely beneficial for Massachusetts residents, as you cannot be denied coverage based on any pre-existing conditions or health issues. However, it is important to note that you do not want to delay enrolling into a plan until you have a health event, as Original Medicare does not have a cap on out-of-pocket maximums and you may rack up a large medical bill if you delay coverage. Most Medicare Supplement companies in Massachusetts also offer an enrollment discount if you are within your first 6 months of your Part B effective date that you would not be eligible for if you delay the coverage.

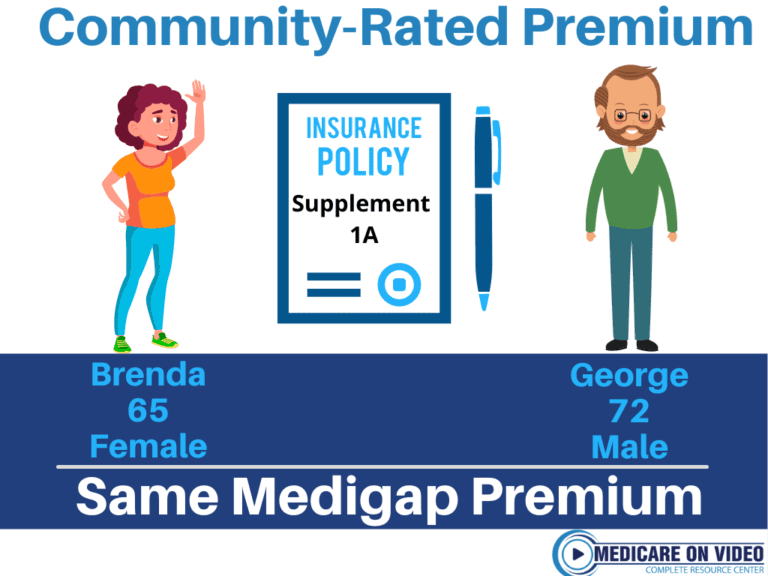

Massachusetts Medicare Supplement Premiums

There are 3 different ways Medicare Supplement premiums can be rated: attained age, issue age, or community-rated. In Massachusetts, Medigap premiums are community-rated. Community-rated premiums mean that everyone in the same area with the same plan will have the same initial premium. In community-rated premium states, age and gender are not factors when calculating initial Medicare Supplement premiums.

What to Know When Signing Up for Medicare in Massachusetts

Now you have at least an initial idea about what to expect when enrolling in Massachusetts Medicare. For an in-depth look at the plans and deadlines, your next step is to download Keith’s Free E-Book, Medicare Made Clear. This book, along with the Medicare On Video website, will be a vital ongoing resource as you approach your enrollment date.

Here are just a few more things to think about. Let’s say you plan to keep working past age 65. If you’re on your employee insurance plan, and your company provides group insurance to over 20 employees, you won’t want Medicare Part B to start just yet. For now, you can enroll exclusively in Part A. If you’ve worked 40 quarters over the course of your lifetime and paid into social security, Medicare Part A will not have a monthly premium. You cannot, however, continue to contribute to a workplace HSA account if you enroll in Medicare Part A. If you have not paid into social security for that duration of time, you will pay a certain amount each quarter to make up the difference dependent on how many quarters you worked. When you decide to formally retire and leave your employee health plan, you will then want to enroll in Part B by going to startpartb.com.

Whether you’re enrolling in one or both parts of Medicare, either at age 65 or upon retirement, you will want to pay very close attention to the date you want your Medicare to take effect. Delays and penalties can be a real hassle, and we recommend preparing and finalizing your paperwork three months in advance — including the employee coverage form you’ll receive from your employer.

We use the term paperwork but, of course, most of the enrollment process now takes place online. This allows for efficiency, validity, convenience, and ease. Medicare On Video can help you navigate the digital enrollment process.

For regular medical coverage, Medicare is an excellent way to equip yourself through your later yours. The limited prescription coverage of Original Medicare can sometimes cause hang-ups, but these problems can frequently be alleviated by investing in a stand-alone Plan D — which you can do separate from a Medicare Advantage plan. You’ll notice how Medicare Original receives fantastic reviews overall, while Medicare Advantage often elicits negative feedback by confining you to a limited network of doctors and wielding hefty out-of-pocket maximums you’d be just as well to avoid.

While Supplement Plan 1A in Massachusetts is extremely similar to Plan G in the rest of the country, we are on hand to answer any questions you might have about how it’s implemented and how to proceed with enrollment.

Give us a call at 877-885-3484 for free consultation on a plan that’s going to give you the best, most stress-free life during your later years. We want to see you with your Medicare card — and the appropriate supplement card — just as soon as you qualify and desire.