Idaho Medicare Plans

Idaho is a great state tucked away in the Pacific Northwest. Other than fantastic potatoes, Idaho is known for beautiful plains and stretches of the Rocky Mountains. With almost a half million residents in Idaho enrolled in Medicare, that makes up for about 1/4th of the overall population! If you are coming into Medicare in the Gem State, you want to make sure you fully understand all of the rules, timelines, and options you have for your health insurance needs!

What are Medicare Options in Idaho?

Idaho, like many states, offers the standard Medicare Supplement plans, also known as Medigap plans. If you are a resident, you can choose from the following plans: A, B, C, D, F, G, H, K, L, M, N, high-deductible Plan F, and high-deductible Plan G. You’re able to enroll during the year, but if you want your coverage to be guaranteed, you want to enroll during your open enrollment period in Idaho.

What are the Most Popular Medicare Supplement Plans in Idaho?

- Medicare Supplement Plan F

- Medicare Supplement Plan G

- Medicare Supplement Plan N

When is the Open Enrollment Period in Idaho?

As a Medicare beneficiary, you can enroll in any Medicare Supplement within your first six months of your Part B effective date. This is considered your open enrollment period.  During this time, insurance carriers are required to approve your MediGap application, and are prohibited from declining the coverage you need because you have a pre-existing condition. You can still apply outside of this window, but you will be required to go through medical underwriting, and could be denied coverage based on your health history.

During this time, insurance carriers are required to approve your MediGap application, and are prohibited from declining the coverage you need because you have a pre-existing condition. You can still apply outside of this window, but you will be required to go through medical underwriting, and could be denied coverage based on your health history.

Can I Change Medicare Supplement Plans in Idaho?

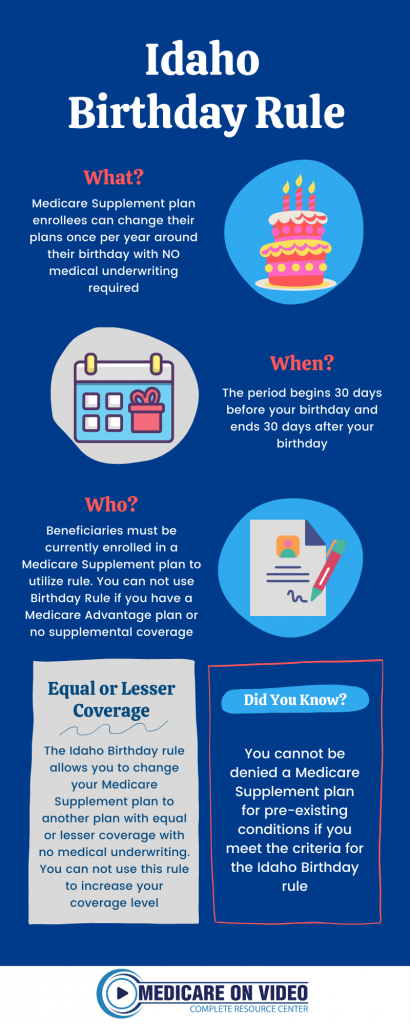

In 2022, Idaho has introduced a brand new rule for beneficiaries to change their Medigap plans! Idaho is now one of few states that gives Medicare Supplement plan enrollees the ability to change their Medigap plans once per year with no medical underwriting. This is know as the Idaho Birthday Rule.

Idaho Birthday Rule

The Idaho Birthday Rule surrounds your birthday and gives Medicare Supplement plan enrollees 63 days to change their Medigap plans with no medical underwriting or health questions.

Like all good things, however, there are a few rules to remember. The first rule is that you must already be enrolled in a Medicare Supplement plan to take advantage of the Birthday Rule. In other words, people with no additional coverage or Medicare Advantage plans do not qualify. The second rule is that you must change your plan to one of equal or lesser coverage. Essentially you can change from one Plan G to another Plan G or down to a Plan N, but you cannot use this rule to change from a Plan N to a Plan G.

Changing MediGap Plans without Idaho Birthday Rule

Outside of using the Idaho Birthday Rule, changing Medicare Supplement plans in Idaho follows the same guidelines as most other states. If six months have passed since your open-enrollment period for Medicare Part B ended, you will need medical underwriting to apply for or change your Medicare Supplement plan. Insurance carriers will look over your medical history, assessing health-related factors, to determine if you should be approved or denied coverage. Because these carriers can deny coverage based on pre-existing conditions, it’s suggested that you enroll in a Medigap plan during your open-enrollment period to ensure you are accepted before your health declines.

Medigap Plan F in Idaho

Medicare Supplement Plan F has been a very popular plan with Medicare beneficiaries over time. The reason for the popularity of Plan F, is that it covers the gaps left by Medicare Part A and B with no out-of-pocket. However, if you became Medicare eligible after January 1st 2020, you are not eligible to enroll in MediGap Plan F. Luckily, there are other great Medicare Supplement plan options available.

Medigap Plan G in Idaho

Medicare Supplement Plan G is a very comprehensive Medicare Supplement plan with very little out-of-pocket expense. Once you have met your Part B annual deductible, MediGap Plan G becomes a full  coverage plan, covering all of the gaps left by Original Medicare, with no additional out-of-pocket expenses. Plan G is typically a very cost-efficient plan with an affordable monthly premium to ensure gold-standard coverage.

coverage plan, covering all of the gaps left by Original Medicare, with no additional out-of-pocket expenses. Plan G is typically a very cost-efficient plan with an affordable monthly premium to ensure gold-standard coverage.

Medigap Plan N in Idaho

Medicare Supplement Plan N is also a great, comprehensive MediGap plan available in Idaho. This plan has slightly more out-of-pocket cost than MediGap Plan G, but also comes with a lower monthly premium. As with Plan G, you are still responsible for the Medicare part B annual deductible. Once you have met this deductible, your Original Medicare coverage kicks in, but you still have some cost-share. With MediGap Plan N, you will pay copayments up to $20 for office visits, and up to $50 for ER visits that do not result in an inpatient admission. Plan N also has the possibility of an excess charges if you use a doctor or healthcare provider that does not accept Medicare Assignment. Excess charges can be up to 15% of the Medicare-approved payment. If the monthly premium difference between Plan G and Plan N is large enough, Plan N is often times a very attractive option for your Medicare Supplement plan.

What is the Cost of a Medicare Supplement Plan in Idaho?

Monthly premiums for Medicare Supplement plans are based on three main factors- age, gender, and location. There are other things that may impact your premium such as tobacco use. The premium amounts will vary based on these factors, so it is important to receive a quote based on your specific demographic information.

Medicare Plans in Idaho for Those Under 65

When it comes to Medicare in Idaho, all MediGap companies who offer Medicare Supplement plans must offer plans to any person enrolled in Medicare Part B. This includes Medicare beneficiaries under age 65 on SSDI. However, often times the premiums on Medicare Supplement plans for individuals under age 65 are much higher than for individuals over age 65. If you fit within this category, there are also Medicare Advantage Policies that you can look into.

However, often times the premiums on Medicare Supplement plans for individuals under age 65 are much higher than for individuals over age 65. If you fit within this category, there are also Medicare Advantage Policies that you can look into.

Once you reach 65, you will be given a new open-enrollment period to choose a Medicare Supplement plan if you want to make a change.

Medicare Advantage in Idaho

This is an alternative to your Original Medicare and Medigap. These will usually carry lower premiums but do come with some restrictions. You’ll be limited to a network of providers. Your providers will bill your Medicare Advantage plan. Keep in mind that these networks are going to be either HMO or PPO style plans. You do have to be enrolled in both Medicare parts to be eligible for a Medicare Advantage Plan and pay for your Part B deductible.

These plans come with one question relating to ESRD or kidney failure. You can enroll during the initial enrollment period and all the annual election window every fall. With Medicare Advantage, you may have lower premiums, but you will be responsible for copays, deductibles, and coinsurance. Many of these plans will also come with Part D prescription drug coverage. Before you enroll, check to make sure your doctor is in the network.

Medicare and Medicaid in Idaho

It is possible to qualify for both Medicare and Medicaid in the state of Idaho. These two programs, however, are separate and have different qualifications you must meet in order to receive benefits. To qualify for Medicaid, you must meet Idaho’s state income requirements. To qualify for Medicare, you must be either over the age of 65, or under 65 but receiving Social Security Disability Insurance for a minimum of 24 months before applying for Medicare.

Download Our Free ebook.

Click the image below for instant access.

In his book “Medicare Made Clear” the #1 authority on Medicare, Keith Armbrecht outlines all you need to know when starting medicare. Easy to follow with videos included. Download Now for Free!